Viral News | Explore around Viral and popular News this year

2025 Retirement Payment Update: Essential Information For Planning Your Future

The latest 2025 Retirement Payment Update is now available to help you plan for your future retirement income. This update includes essential information on changes to Social Security, Medicare, and other retirement-related programs. It is important to review this information so that you can make informed decisions about your retirement savings and planning.

Our team of experts has analyzed the latest data and conducted extensive research to provide you with this comprehensive guide. By understanding the key differences and takeaways outlined in this update, you can make informed decisions about your retirement planning.

Key Differences and Takeaways:

| Feature | 2025 Update |

|---|---|

| Social Security Full Retirement Age | 67 for those born in 1960 |

| Medicare Part B Premium | $164.90 per month |

| Roth IRA Contribution Limit | $6,500 (plus catch-up contributions for those age 50 and older) |

| 401(k) Contribution Limit | $22,500 (plus catch-up contributions for those age 50 and older) |

FAQ

As you plan for your retirement in 2025, staying informed about the latest updates is crucial. Here are answers to frequently asked questions to help clarify any concerns:

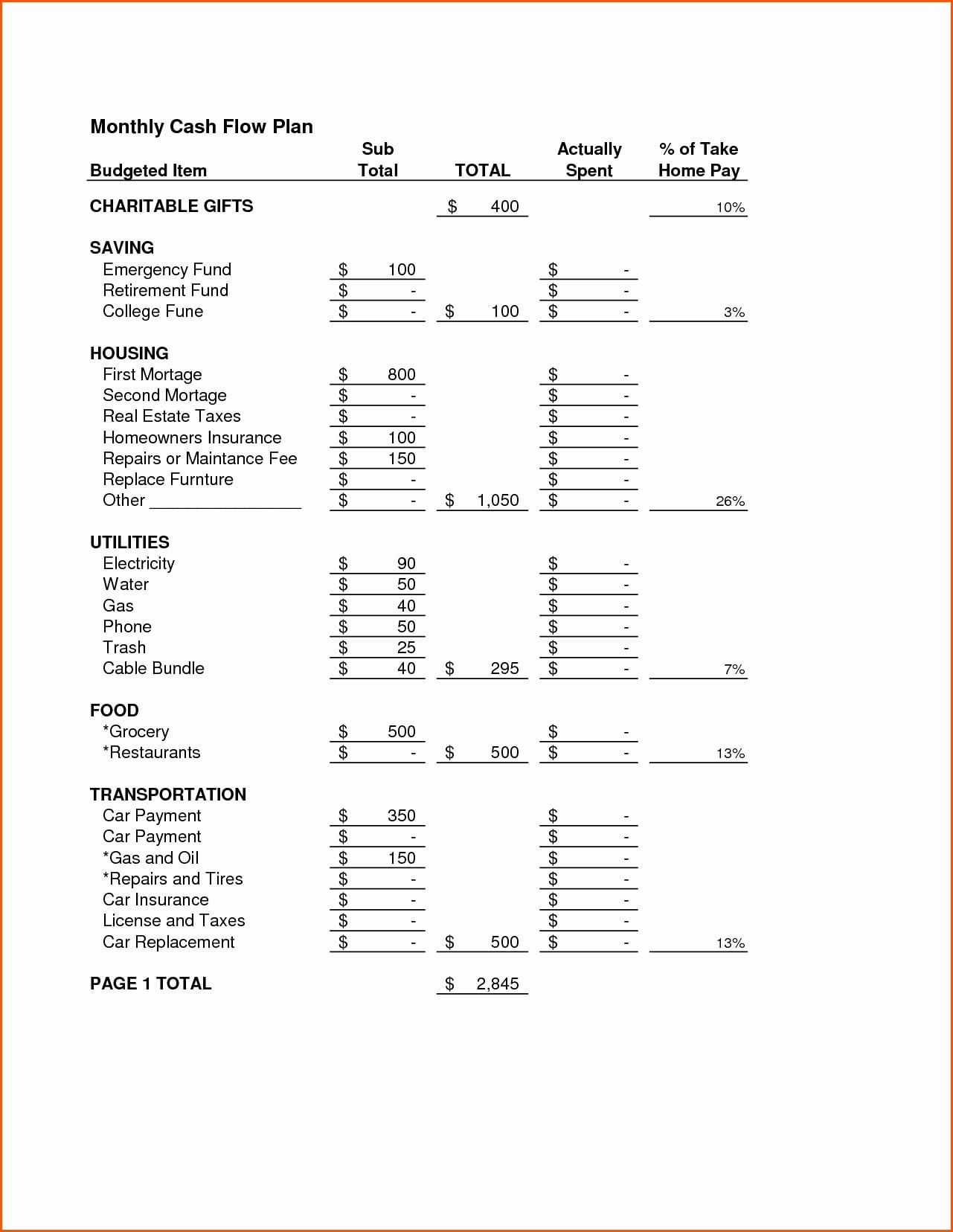

Retirement Planning Et Monthly Answers Dave Ramsey Fidelity — db-excel.com - Source db-excel.com

Question 1: When will the 2025 Retirement Payment Update be implemented?

The 2025 Retirement Payment Update is expected to take effect on January 1st, 2025.

Question 2: What changes will the update bring?

The update will adjust the retirement payment formula, potentially affecting the monthly benefit amounts.

Question 3: How will the update impact my retirement plan?

The impact will vary depending on individual circumstances. It's advisable to review your retirement plan and consult with a financial advisor for personalized guidance.

Question 4: What steps should I take now to prepare for the update?

Stay updated with the latest information, consider increasing your retirement contributions, and explore alternative sources of income.

Question 5: Are there any exceptions or exclusions to the update?

The exact details of the update are still being finalized. Consult official sources for the most accurate information.

Question 6: Where can I find more information about the update?

Refer to the Social Security Administration's website or consult with representatives for the most up-to-date information.

Remember, planning for retirement requires a comprehensive approach. Seek professional advice, and stay informed about changes affecting your future financial security.

See our next article for additional insights into optimizing your retirement planning strategies.

Tips

Planning for retirement can be a daunting task, but it's essential to ensure a comfortable future. With the 2025 Retirement Payment Update: Essential Information For Planning Your Future, you can stay up-to-date on the latest changes and make informed decisions.

Tip 1: Understand the New Payment Schedule

The update introduces a new payment schedule for retirement benefits. It's crucial to familiarize yourself with the changes and how they will affect your future income.

Tip 2: Maximize Your Contributions

The update encourages individuals to contribute more to their retirement accounts. Consider increasing your contributions to 401(k) plans and IRAs to maximize potential returns.

Tip 3: Review Your Investment Strategy

The update highlights the importance of reviewing your investment strategy. Ensure your portfolio aligns with your risk tolerance and retirement goals.

Tip 4: Explore Catch-Up Contributions

For those nearing retirement, the update allows for catch-up contributions. These contributions can help boost your retirement savings.

Tip 5: Plan for Healthcare Costs

The update emphasizes the need to plan for healthcare costs in retirement. Explore Medicare and private insurance options to ensure you have adequate coverage.

Tip 6: Consider Part-Time Work

The update suggests considering part-time work in retirement to supplement your income and stay active.

Tip 7: Seek Professional Advice

If needed, consult with a financial advisor to discuss your retirement plans and make informed decisions.

The 2025 Retirement Payment Update provides valuable information to help you plan for a secure financial future. By following these tips, you can navigate the changes and ensure a comfortable retirement.

2025 Retirement Payment Update: Essential Information For Planning Your Future

Planning for retirement is a crucial financial undertaking, and understanding the upcoming 2025 Retirement Payment Update is essential. This update will impact the amount of benefits you receive from Social Security and other retirement programs.

- Benefit Increase: Social Security benefits are expected to increase by 1.6% in 2025.

- Earnings Limit: The maximum amount of income you can earn before your Social Security benefits are reduced will increase in 2025.

- Taxation: The way Social Security benefits are taxed may change in 2025.

- Survivor Benefits: Surviving spouses and children may receive higher benefits under the 2025 update.

- Contribution Limits: The maximum amount you can contribute to retirement accounts, such as IRAs and 401(k)s, may increase in 2025.

- Age Requirements: The age at which you can claim full Social Security benefits may change in 2025.

6 Essential Retirement Planning and Savings Tips - Source www.lowerythomas.com

These key aspects of the 2025 Retirement Payment Update will affect your retirement planning. By understanding these changes, you can make informed decisions about your retirement savings, investment strategies, and income planning. The earlier you start planning, the better prepared you will be when the updates take effect.

2025 Retirement Payment Update: Essential Information For Planning Your Future

The 2025 Retirement Payment Update provides essential information for individuals planning their financial future. Understanding the changes to retirement payments in 2025 is crucial for making informed decisions about retirement savings and investments. This update affects various aspects of retirement planning, such as the age of eligibility for Social Security benefits, the calculation of benefits, and the impact on taxes.

Retirement Planning | Retirement planning, How to plan, Retirement - Source www.pinterest.com

The gradual increase in the full retirement age for Social Security benefits is a significant change. By 2025, individuals born in 1960 or later will need to wait until age 67 to receive full benefits. This change affects the planning horizon for retirement, as individuals may need to work longer to accumulate sufficient savings.

Moreover, the update introduces changes to the calculation of Social Security benefits. The formula used to calculate the primary insurance amount, which determines the monthly benefit, will be revised. This revision may result in lower benefits for some individuals and higher benefits for others, depending on their earnings history and retirement age.

In addition, the update addresses the impact of taxes on retirement payments. The taxation of Social Security benefits may change in 2025, potentially affecting the net income received by retirees. Understanding the tax implications is crucial for managing retirement income effectively.

The 2025 Retirement Payment Update serves as a valuable resource for individuals planning for their retirement. By staying informed about these changes, individuals can make informed decisions about their retirement savings, investments, and overall financial planning. This knowledge empowers individuals to take control of their financial future and ensure a secure retirement.