Viral News | Explore around Viral and popular News this year

2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil

2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil: Learn about the importance of the 2025 São Paulo IPVA and how to consult it.

Editor's Notes: 2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil" have published today date. With the 2025 São Paulo IPVA deadline approaching, it's important for vehicle owners in SP, Brazil to understand how to consult their IPVA and make the necessary payments.

Our team has done the analysis, dug into the information, and put together this 2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil guide to help you make the right decision.

Key differences or Key takeways:

| Feature | 2025 São Paulo IPVA |

|---|---|

| Payment deadline | TBD |

| Discount for early payment | TBD |

| Fine for late payment | TBD |

Main article topics:

- What is the IPVA?

- Who needs to pay the IPVA?

- How to consult your IPVA

- How to make the IPVA payment

- What are the benefits of paying the IPVA on time?

- What are the consequences of not paying the IPVA?

FAQ

This FAQ section provides comprehensive answers to frequently asked questions regarding the São Paulo IPVA consultation process for vehicle owners in SP, Brazil.

Question 1: When is the IPVA due date for São Paulo vehicles in 2025?

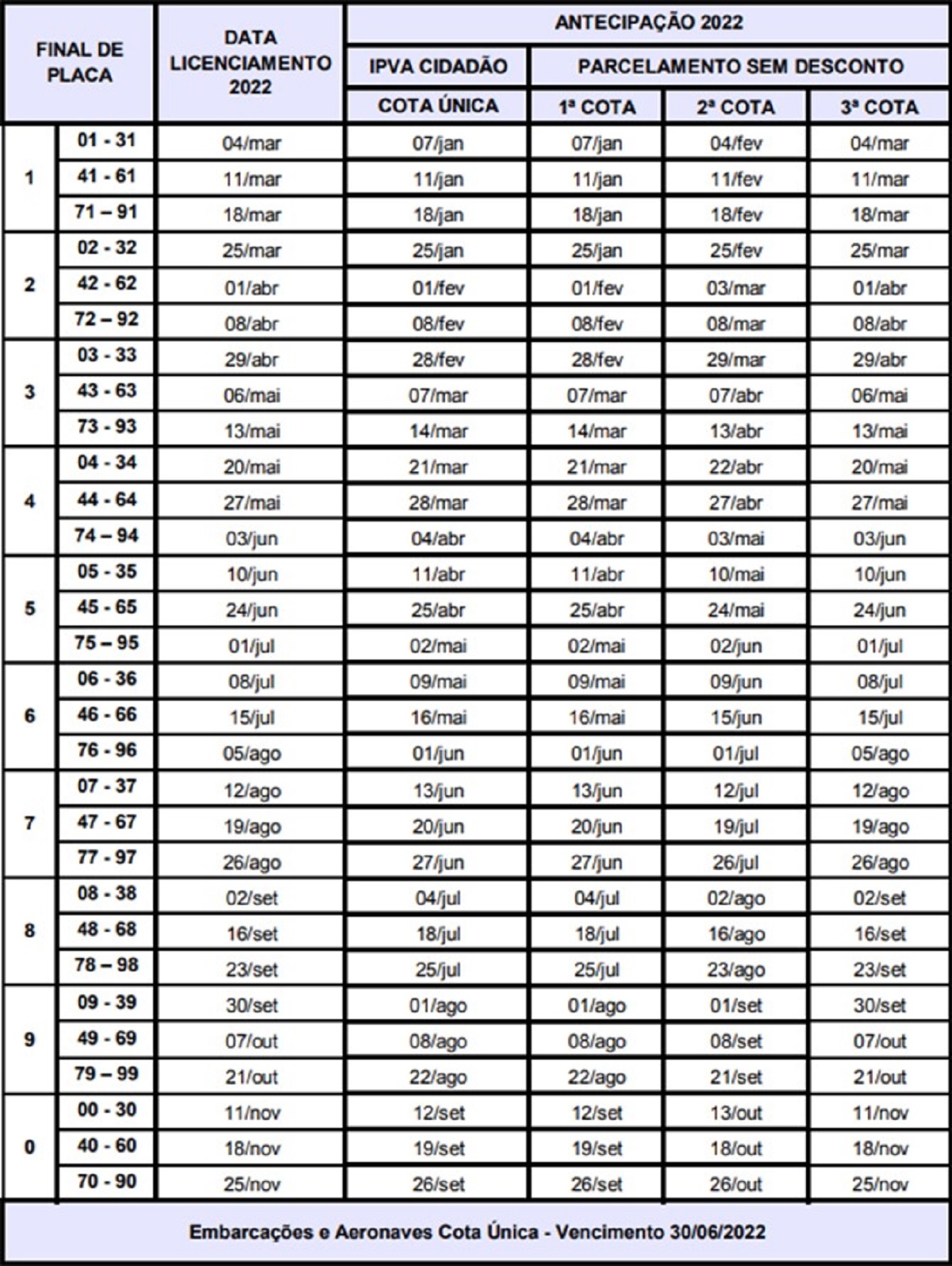

The IPVA due date for São Paulo vehicles in 2025 varies depending on the final digit of the license plate number. The schedule is as follows:

- Final digit 1 or 2: March

- Final digit 3 or 4: April

- Final digit 5 or 6: May

- Final digit 7 or 8: June

- Final digit 9 or 0: July

.

Feriados Em Sao Paulo 2025 - Adrian Roberts - Source adrianroberts.pages.dev

Question 2: How can I consult my IPVA online?

To consult your IPVA online, visit the website of the São Paulo State Treasury Department (Secretaria da Fazenda do Estado de São Paulo) at fazendasp.sp.gov.br. Enter your license plate number and the system will display your IPVA information.

Question 3: What is the IPVA percentage for São Paulo vehicles in 2025?

The IPVA percentage for São Paulo vehicles in 2025 is 4%. This percentage is applied to the taxable value of the vehicle, which is determined by the market value.

Question 4: Can I pay my IPVA in installments?

Yes, you can pay your IPVA in up to three installments. The first installment is due on the date specified for your license plate number, and the remaining installments are due on the following months.

Question 5: What are the consequences of not paying my IPVA?

If you do not pay your IPVA on time, you will be subject to fines and penalties. The amount of the fine will depend on the number of days overdue.

Question 6: What documents do I need to renew my vehicle license?

To renew your vehicle license, you will need to present the following documents:

- Original and copy of the IPVA payment receipt

- Original and copy of the vehicle license

- Original and copy of the proof of insurance

- Original and copy of the emissions certificate

.

This FAQ section provides essential information to help vehicle owners in SP, Brazil, understand and comply with the IPVA consultation and payment process.

Continue reading for additional insights and guidance on related topics.

Tips

This guide provides comprehensive information on the 2025 São Paulo IPVA, including payment deadlines, discounts, exemptions, and online consultation methods. Utilize these tips to navigate the process seamlessly.

WorldView-4 Satellite Image Sao Paulo, Brazil | Satellite Imaging Corp - Source www.satimagingcorp.com

Tip 1: Check Payment Deadlines: Adhere to the specified payment deadlines to avoid late fees and potential penalties. The guide outlines the exact dates for each installment.

Tip 2: Take Advantage of Discounts: Explore available discounts, such as the early payment discount, to reduce your IPVA obligation. Details regarding eligibility and applicable discounts are provided within the guide.

Tip 3: Verify Exemptions: Determine if your vehicle qualifies for any exemptions that may apply, such as those for vehicles with disabilities or antique vehicles. The guide offers a comprehensive list of exemptions and their respective requirements.

Tip 4: Utilize Online Consultation: Leverage the convenience of online consultation to access your IPVA information, generate payment slips, and even make payments securely. The guide provides step-by-step instructions for online consultation.

Tip 5: Consult the Complete Guide: 2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil. For a comprehensive understanding of the 2025 São Paulo IPVA, refer to the complete guide. It covers all aspects of the process, including payment procedures, documentation requirements, and possible contingencies.

By following these tips and utilizing the comprehensive guide, vehicle owners in São Paulo can effectively manage their 2025 IPVA obligations and ensure compliance with local regulations.

2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil

Understanding the intricacies of the 2025 São Paulo IPVA consultation process is crucial for vehicle owners in the state of SP, Brazil. This guide delves into six key aspects that will aid in navigating the process effectively.

- Vehicle Identification: Determine the specific vehicle for which IPVA information is required.

- Tax Calculation: Understand the factors that influence IPVA calculation, including vehicle value and engine displacement.

- Payment Options: Explore the various payment methods available, including online portals and bank branches.

- Consultation Channels: Identify the official channels through which IPVA information can be obtained, such as the state's fiscal department website.

- Due Dates: Be aware of the established deadlines for IPVA payment to avoid penalties.

- Exemptions and Reductions: Determine if the vehicle qualifies for any exemptions or reductions that may impact the IPVA amount.

IPVA PA 2022 oferece até 15% de desconto aos contribuintes - Source autopapo.uol.com.br

Navigating the 2025 São Paulo IPVA consultation process requires attention to these key aspects. Vehicle owners must accurately identify their vehicle, understand the tax calculation, and explore the available payment options. Additionally, knowing the official consultation channels, payment deadlines, and potential exemptions or reductions ensures timely and efficient IPVA management.

2025 São Paulo IPVA Consultation: Complete Guide For Vehicle Owners In SP, Brazil

The 2025 São Paulo IPVA consultation is an essential resource for vehicle owners in the state of São Paulo, Brazil. This guide provides comprehensive information on how to consult and pay the IPVA (Property Tax on Motor Vehicles), including deadlines, payment options, and potential discounts. Understanding the IPVA consultation process is crucial for fulfilling tax obligations and avoiding penalties.

Unlock Your Savings: IPVA 2025 Guide Available January 8 in Rio de - Source news.faharas.net

The IPVA is an annual tax levied on all vehicles registered in São Paulo. It is calculated based on the vehicle's value and is used to fund public services such as road maintenance and transportation infrastructure. The consultation process allows vehicle owners to verify their IPVA balance, payment history, and any applicable discounts or exemptions.

The 2025 São Paulo IPVA consultation can be accessed online through the official website of the São Paulo State Treasury Secretariat (SEFAZ-SP). Vehicle owners will need to provide their vehicle's license plate number or RENAVAM (National Vehicle Registration Number) to access the consultation portal. The portal provides real-time information on the IPVA balance, due dates, and payment options available.

Vehicle owners have several payment options for their IPVA, including online banking, credit or debit cards, and in-person payments at authorized banks and lottery outlets. Paying the IPVA on time can result in discounts and avoid late payment penalties. Additionally, vehicle owners who have multiple vehicles registered in their name may qualify for a discount on their IPVA.

Failure to pay the IPVA by the established deadlines can result in fines, interest charges, and even the impounding of the vehicle. Therefore, it is essential for vehicle owners to consult the 2025 São Paulo IPVA consultation guide and fulfill their tax obligations promptly.

Table: Key Information Regarding 2025 São Paulo IPVA Consultation

| Item | Details |

|---|---|

| Consultation Website | Official website of SEFAZ-SP |

| Payment Options | Online banking, credit/debit cards, banks, lottery outlets |

| Discounts | Available for on-time payments and multiple vehicle registrations |

| Penalties | Fines, interest charges, vehicle impoundment for late payments |

| Importance | Fulfilling tax obligations, avoiding penalties, and contributing to public services |

Conclusion

Understanding the 2025 São Paulo IPVA consultation process is crucial for vehicle owners in SP, Brazil. By consulting and paying the IPVA on time, they can avoid penalties, take advantage of discounts, and contribute to the state's infrastructure development. This guide provides comprehensive information to help vehicle owners navigate the consultation process, ensuring timely tax payments and compliance with legal obligations.

Fulfillment of IPVA obligations not only demonstrates responsible citizenship but also contributes to the maintenance of essential public services that benefit all residents of São Paulo. Vehicle owners are encouraged to consult the 2025 São Paulo IPVA consultation guide, stay informed about payment deadlines, and take advantage of the available payment options to fulfill their tax responsibilities effectively and efficiently.