Viral News | Explore around Viral and popular News this year

Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors

"Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors" released with effective date.

Editor's Notes: "Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors" have published today date. This guide about the capital gains tax changes in Canada is important for investors to read because it will help them understand how the changes will affect their investments.

After doing some analysis, digging into Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors and made this guide to help you make the right decision.

| Key Differences | Key Takeaways |

|---|---|

| Before 1972: 50% of capital gains were taxable as income. | After 1971: 50% inclusion rate introduced, meaning only half of capital gains subject to tax. |

| Before 2006: Capital gains taxed at same rate as income. | After 2006: Capital gains inclusion rate reduced to 50%. |

| Before 2018: Superficial loss rules applied to 30-day period. | After 2017: Superficial loss rules extended to 60-day period. |

Transition to main article topics:

FAQ

This FAQ section provides comprehensive answers to common questions regarding capital gains tax changes in Canada, offering valuable guidance for investors to navigate the updated regulations.

Question 1: What are the key changes to capital gains tax rules in Canada?

The most significant change is the introduction of a two-tiered inclusion rate system. 50% of capital gains are now included in taxable income, with a rate of 50% above the basic personal amount, effectively reducing the tax rate for many investors.

Question 2: How do the new rules impact principal residences?

The principal residence exemption remains in place, meaning that gains from the sale of a primary residence are not taxable. However, the exemption now only applies to one property at a time.

Question 3: What is the difference between superficial loss rules and deemed disposition rules?

Superficial loss rules prevent investors from claiming a capital loss when they sell and reacquire the same or a similar property within 30 days. Deemed disposition rules require investors to report capital gains on certain events, such as emigrating from Canada or converting a property to rental use.

Question 4: How can investors maximize their tax savings under the new rules?

Investors should consider utilizing tax-advantaged accounts, such as TFSAs and RRSPs, to shelter capital gains from taxation. Additionally, they can optimize their investment strategies to minimize the realization of capital gains.

Question 5: What are the penalties for not complying with the new capital gains tax rules?

Failure to report capital gains accurately can result in significant penalties, including interest and late payment charges. It is crucial to seek professional advice if there is any uncertainty about tax obligations.

Question 6: Where can investors find additional information on the capital gains tax changes?

The Canada Revenue Agency (CRA) website provides comprehensive information and resources on the new tax rules. Investors can also consult with tax professionals for personalized guidance.

Tips

Understanding the nuances of Canada's capital gains tax is crucial for investors seeking to maximize their returns and minimize tax implications. The following tips provide valuable guidance in navigating these changes effectively.

Tip 1: Leverage Tax-Advantaged Accounts

Maximize Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors by utilizing tax-advantaged accounts like Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs). These accounts allow capital gains to accumulate tax-free, amplifying long-term wealth growth.

Tip 2: Time Capital Gains Realizations

Plan capital gains realizations strategically to take advantage of lower tax rates. Consider selling assets in years with lower overall income levels to minimize the tax impact. This approach allows for greater capital gains retention and enhanced investment opportunities.

Tip 3: Minimize Taxable Capital Gains

Explore strategies to reduce taxable capital gains. Utilize capital losses to offset gains, consider tax-loss harvesting techniques, or engage in income splitting with eligible family members. These measures effectively lower the tax burden associated with capital gains.

Tip 4: Understand Principal Residence Exemption

Leverage the Principal Residence Exemption to exempt eligible capital gains from taxation. This exemption protects the gains realized upon the sale of a primary residence in Canada, providing homeowners with significant tax savings.

Tip 5: Stay Informed on Tax Regulations

Capital gains tax regulations are subject to ongoing updates and changes. Monitor these changes closely through reputable sources to ensure compliance and optimize tax planning strategies. By staying abreast of the latest developments, investors can make informed decisions that maximize their financial benefits.

Successfully navigating the complexities of capital gains tax requires a comprehensive understanding of the implications and effective implementation of mitigation strategies. Consulting with financial experts and staying up-to-date on tax regulations is vital for maximizing investment returns while adhering to legal obligations.

Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors

Understanding the intricate workings of capital gains tax is crucial for Canadian investors to optimize their returns and minimize their tax liabilities. Recent changes have added complexity to this landscape, and investors must be well-informed to navigate these modifications effectively. This comprehensive guide explores six key aspects of capital gains tax changes in Canada to equip investors with the knowledge they need to make informed decisions.

- Tax Rates: The revised tax rates for capital gains have created a more progressive tax system, with higher rates applicable to higher incomes.

- Inclusion Rate: The inclusion rate for capital gains has increased, meaning a larger portion of capital gains is now subject to taxation.

- Principal Residence Exemption: Changes to the principal residence exemption rules have impacted the eligibility criteria and the calculation of the exemption amount.

- Deemed Disposition Rules: The deemed disposition rules have been revised, affecting the timing of capital gains and the ability to defer taxes.

- Foreign Assets: Capital gains from foreign assets are now subject to Canadian tax, with specific rules for calculating the foreign exchange gain or loss.

- Taxation of Trusts: The tax treatment of capital gains within trusts has been modified, introducing new complexities for trust beneficiaries.

These changes underscore the importance of investors seeking professional advice from tax experts. By understanding the nuances of these revisions, investors can develop tailored strategies to minimize their tax burden and maximize their investment returns. The interplay between these aspects highlights the intricate nature of capital gains taxation in Canada, necessitating a comprehensive understanding for informed decision-making.

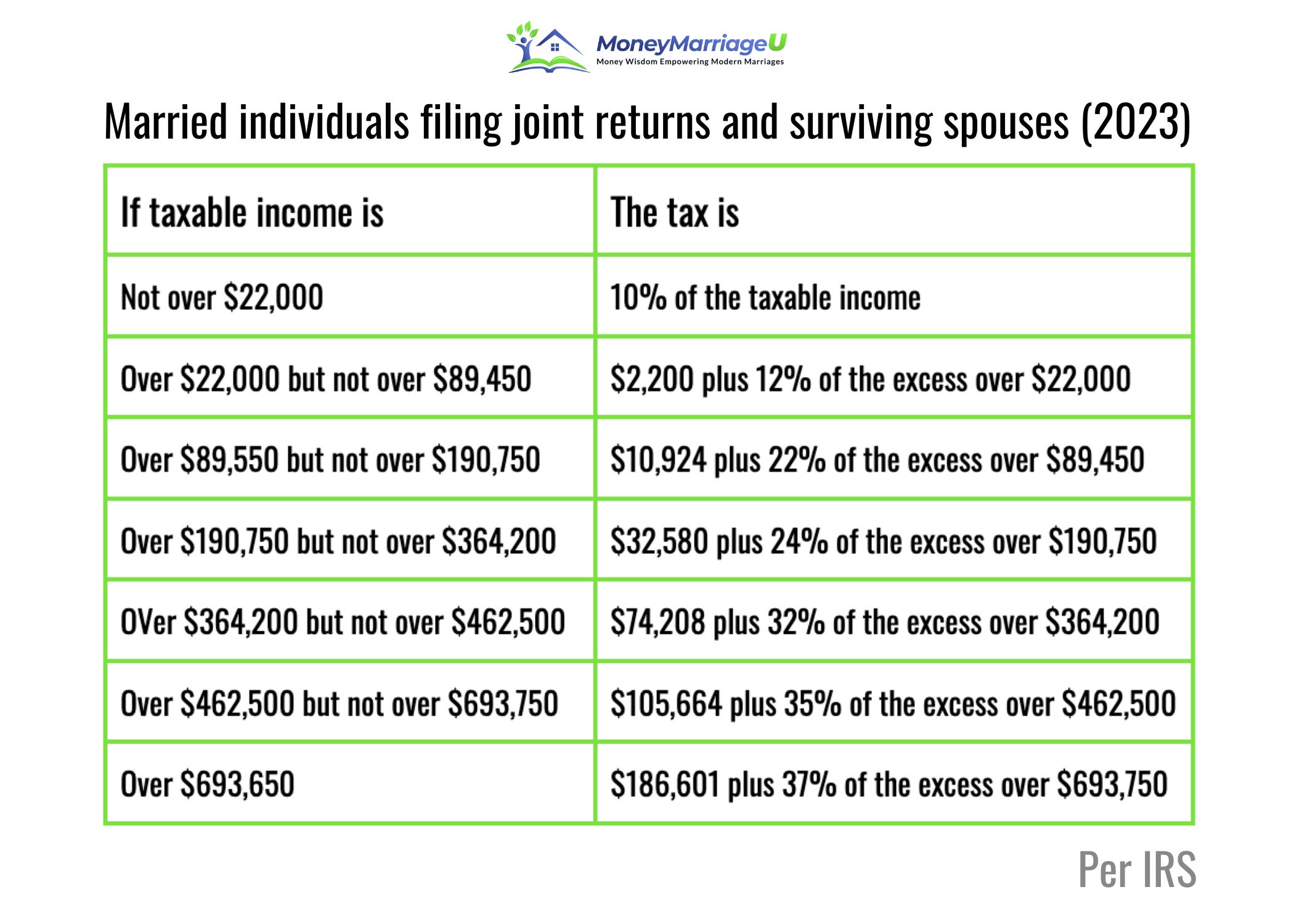

New Irs Tax Brackets 2023 Calculator - PELAJARAN - Source www.pelajaran.guru

Capital Gains Tax Changes In Canada: Comprehensive Guide For Investors

The Capital Gains Tax (CGT) is a tax on the profit made when you sell an asset that has increased in value. In Canada, capital gains are taxed at a rate of 50% of your marginal tax rate. This means that if you are in the highest tax bracket, you will pay 25% capital gains tax. The CGT is a significant consideration for investors, as it can impact their investment returns. The recent changes to the CGT in Canada have made it even more important for investors to understand how it works.

Capital Gains Tax Canada 2024 Calculator - Prudi Carlotta - Source beretnicolea.pages.dev

One of the most important changes to the CGT is the introduction of the Principal Residence Exemption (PRE). The PRE allows you to exempt the capital gain on the sale of your principal residence from taxation. This exemption is only available to Canadian residents, and it is limited to one property per individual. The PRE can be a valuable tax saving tool for homeowners, as it can save you a significant amount of money on capital gains tax.

Another important change to the CGT is the reduction in the capital gains inclusion rate. The capital gains inclusion rate is the percentage of your capital gain that is subject to taxation. Prior to 2017, the capital gains inclusion rate was 50%. However, the federal budget of 2017 reduced the inclusion rate to 25%. This change has made it more beneficial for investors to hold investments for a longer period of time, as they will pay less capital gains tax when they eventually sell.

The changes to the CGT in Canada are significant, and they can have a material impact on your investment returns. It is important to understand how these changes work so that you can make informed investment decisions.

Here is a table summarizing the key changes to the CGT in Canada:

| Change | Details |

|---|---|

| Principal Residence Exemption | Exempts the capital gain on the sale of your principal residence from taxation. |

| Capital gains inclusion rate | The percentage of your capital gain that is subject to taxation has been reduced from 50% to 25%. |