Viral News | Explore around Viral and popular News this year

CNPJ Receita Federal: A Comprehensive Guide To Understanding And Using The Brazilian Tax ID

Deciphering and utilizing Brazil's tax identification system, CNPJ Receita Federal, can be a daunting task. But it's crucial for navigating the country's fiscal landscape. Let's delve into this comprehensive guide to unravel its intricacies.

Editor's Notes: CNPJ Receita Federal: A Comprehensive Guide To Understanding And Using The Brazilian Tax ID has been meticulously crafted by our team of experts to empower individuals and businesses alike in their dealings with Brazil's tax authorities.

Through thorough analysis and meticulous information gathering, we present this guide as an indispensable resource for understanding and effectively utilizing CNPJ Receita Federal. By providing key insights, we aim to simplify the complexities of Brazil's tax system and empower our readers to make informed decisions.

| Key Differences | |

|---|---|

| Purpose | Unique identifier for businesses and legal entities |

| Format | 14-digit alphanumeric code |

| Obtaining | Assigned by the Brazilian Federal Revenue Service (Receita Federal) |

Now, let's delve into the heart of CNPJ Receita Federal, exploring its benefits and key components.

FAQs

This comprehensive guide provides a detailed overview of the CNPJ, its significance, and practical applications, addressing common inquiries and misconceptions.

Question 1: What is the purpose and importance of the CNPJ?

The CNPJ (Cadastro Nacional da Pessoa Jurídica) is the Brazilian Tax ID, a unique 14-digit identifier assigned to every legal entity operating in Brazil. It plays a crucial role in tax administration, allowing the Federal Revenue Service to monitor and regulate business activities effectively.

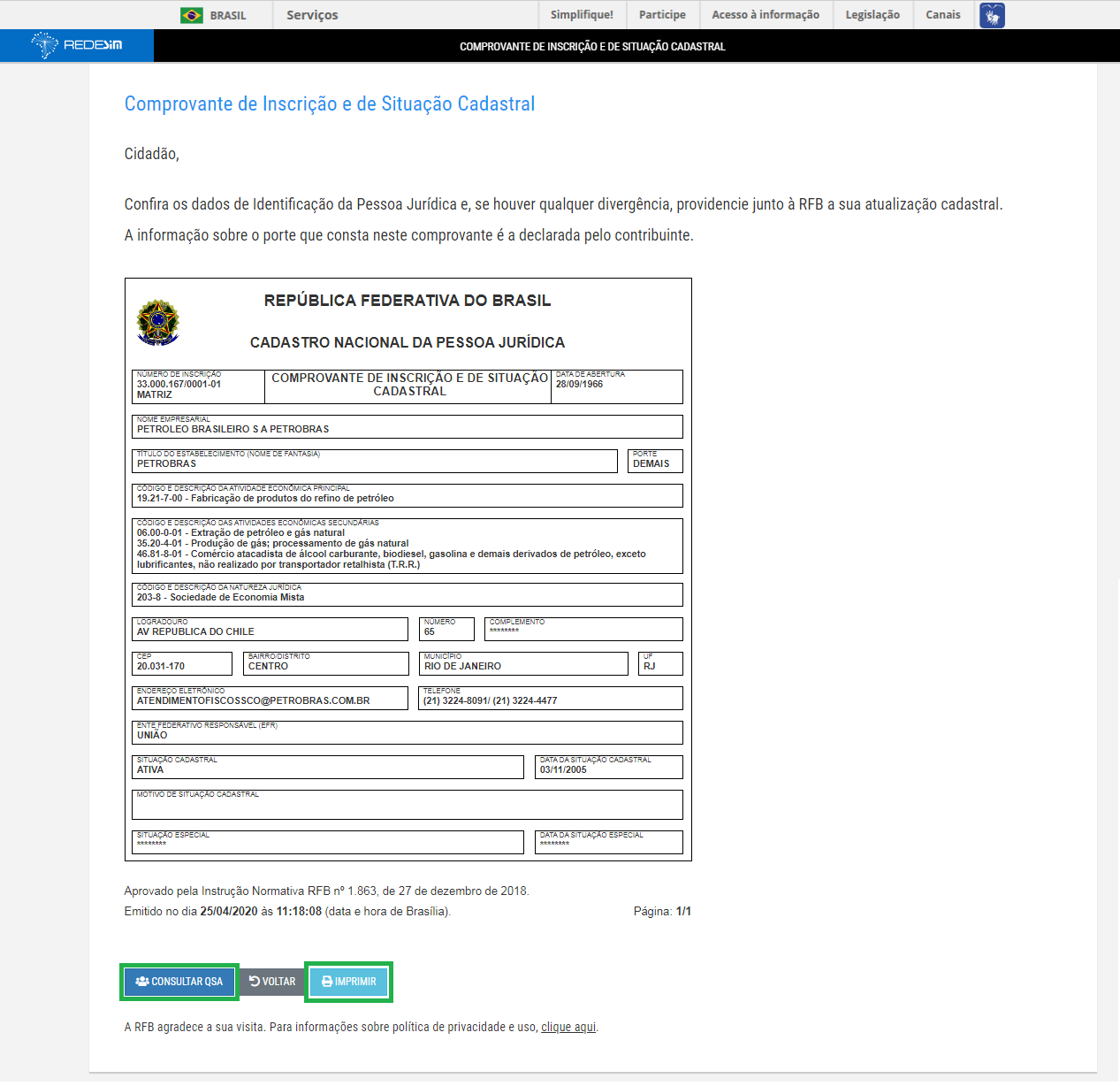

Como Consultar Um Cnpj Na Receita Federal - Source monroe.com.au

Question 2: Is it mandatory for all businesses to have a CNPJ?

Yes, obtaining a CNPJ is legally required for all companies and organizations conducting business in Brazil. Without a valid CNPJ, businesses cannot legally operate, open bank accounts, or engage in commercial transactions.

Question 3: What are the steps involved in obtaining a CNPJ?

To acquire a CNPJ, businesses must complete the Cadastro Nacional de Pessoa Jurídica (CNPJ) application online through the e-CAC portal of the Federal Revenue Service. The process requires providing detailed information about the business, including its legal structure, activities, and responsible individuals.

Question 4: What are the common mistakes to avoid when using a CNPJ?

Businesses should ensure that they use their CNPJ correctly on all official documents, invoices, and correspondence to maintain compliance and avoid penalties. Additionally, they should keep their CNPJ information updated and promptly report any changes to the Federal Revenue Service.

Question 5: What are the consequences of not having a valid CNPJ?

Operating a business without a valid CNPJ is a serious offense in Brazil and can result in significant fines, legal penalties, and reputational damage. It can also hinder business operations and limit access to essential services.

Question 6: Where can I find more information and support related to CNPJ?

For further guidance and assistance, businesses can consult the official website of the Federal Revenue Service (https://www.gov.br/receitafederal) or seek professional advice from tax attorneys or accountants specializing in Brazilian tax matters.

By understanding and properly utilizing the CNPJ, businesses can ensure compliance, streamline operations, and maintain a positive standing with the Brazilian tax authorities.

Explore Further:

Tips by CNPJ Receita Federal: A Comprehensive Guide To Understanding And Using The Brazilian Tax ID

This guide contains valuable tips to help you understand and use the Brazilian Tax ID (CNPJ) effectively.

A Comprehensive Guide to Brazilian Coffee Beans - Coffee Dusk - Source coffeedusk.com

Understanding the CNPJ and its applications is crucial for businesses and individuals interacting with the Brazilian tax system. Here are some essential tips to guide you:

Tip 1: Understand the Structure of the CNPJ

The CNPJ is a 14-digit number that uniquely identifies businesses in Brazil. It comprises several sections, including the state registration number, municipality code, and verification digits. Understanding the structure of the CNPJ will help you identify and validate the tax ID.

Tip 2: Obtain the CNPJ for Your Business

Acquiring a CNPJ is essential for businesses operating in Brazil. You can obtain the CNPJ by registering your business with the CNPJ Receita Federal website. The process involves providing information about your business, including its legal name, address, and activities.

Tip 3: Use the CNPJ for Fiscal Obligations

The CNPJ is used for various fiscal obligations, such as filing taxes, issuing invoices, and participating in government procurement. Make sure to use the correct CNPJ on all relevant documents to ensure compliance with tax regulations.

Tip 4: Verify the Authenticity of a CNPJ

To avoid fraudulent activities, it is important to verify the authenticity of a CNPJ. You can use the CNPJ Receita Federal website to check the validity of a CNPJ and confirm that it belongs to a legitimate business.

Tip 5: Keep Your CNPJ Information Up-to-Date

Maintain accurate and up-to-date information associated with your CNPJ. Report any changes to your business, such as address or activities, to the CNPJ Receita Federal to avoid penalties and ensure smooth tax administration.

By following these tips, you can effectively understand and utilize the CNPJ for tax compliance and business operations in Brazil.

CNPJ Receita Federal: A Comprehensive Guide To Understanding And Using The Brazilian Tax ID

CNPJ Receita Federal, established by the Brazilian Federal Revenue, serves as the central registry for businesses and legal entities operating within Brazil. Understanding and utilizing this unique identifier is crucial for successful business operations and compliance with Brazilian tax regulations.

- Structure: 14-digit numerical code, formatted with dashes and a control digit.

- Mandatory: Required for all businesses and organizations registered in Brazil.

- Unique: Each entity is assigned a distinct CNPJ, ensuring identification and tax administration.

- Identification: Key for tax filings, invoicing, and official communications.

- Verification: Can be validated through the Receita Federal website to ensure authenticity.

- Compliance: Compliance with CNPJ obligations ensures smooth business operations and avoids penalties.

These aspects of CNPJ Receita Federal underscore its importance as a central identifier for Brazilian businesses. It facilitates tax administration, ensures compliance, and supports efficient business transactions within the country's regulatory framework.

Informativo Semanal – Serão declarados inaptos 3,4 milhões de inscritos - Source grupoborn.com.br

CNPJ Receita Federal: A Comprehensive Guide To Understanding And Using The Brazilian Tax ID

The CNPJ (Cadastro Nacional da Pessoa Jurídica) is a unique 14-digit identifier assigned to all legal entities in Brazil by the Receita Federal, the Brazilian Federal Revenue Service. It is essential for businesses operating in Brazil, as it is used for a wide range of purposes, including tax identification and registration, opening bank accounts, and entering into contracts.

Módulo Desktop - Painel de Configurações - Variáveis - Validar CPF/CNPJ - Source wiki.elitesoft.com.br

Understanding and using the CNPJ correctly is essential for businesses operating in Brazil. This guide will provide a comprehensive overview of the CNPJ, including its structure, how to obtain one, and how to use it for various purposes.

This guide will provide you with a comprehensive understanding of how to obtain and use the CNPJ for your business in Brazil.

| Topic | Description |

|---|---|

| What is the CNPJ? | The CNPJ is a unique 14-digit identifier assigned to all legal entities in Brazil. |

| How to obtain a CNPJ | To obtain a CNPJ, you must register your business with the Receita Federal. |

| How to use the CNPJ | The CNPJ is used for a wide range of purposes, including tax identification and registration, opening bank accounts, and entering into contracts. |

Conclusion

The CNPJ is an essential tool for businesses operating in Brazil. By understanding and using the CNPJ correctly, businesses can ensure that they are compliant with Brazilian tax laws and regulations.

This guide has given you a comprehensive overview of the CNPJ. For more information, please visit the Receita Federal website.