Viral News | Explore around Viral and popular News this year

CPF Na Nota: Maximize Your Savings And Support Brazilian Society

CPF Na Nota: Maximize Your Savings And Support Brazilian Society? Yes! CPF Na Nota is a Brazilian government program that allows taxpayers to receive discounts on purchases by providing their CPF (Cadastro de Pessoas Físicas) number at the point of sale. The program has two main benefits: it helps taxpayers save money on their purchases, and it provides financial support to social welfare programs in Brazil.

Editor's Notes: "CPF Na Nota: Maximize Your Savings And Support Brazilian Society" have published today on July 17, 2023, to bring alert for those share to care about our society and poverty. Also help to understand the tax benefits they can get from this program.

Our team has analyzed the CPF Na Nota program and put together this guide to help you understand how it works, how to participate, and how to maximize your savings. We've also included information on how the program supports Brazilian society. So if you're looking for a way to save money and support a good cause, CPF Na Nota is a great option.

Key differences or Key takeways

| Feature | Benefit |

|---|---|

| Discounts on purchases | Save money on your everyday purchases |

| Support for social welfare programs | Help improve the lives of Brazilians in need |

| Easy to participate | Simply provide your CPF number at the point of sale |

How to participate in CPF Na Nota:

- Register for the program online at the CPF Na Nota website.

- Provide your CPF number at the point of sale when you make a purchase.

- You will receive a discount on your purchase and the government will donate a portion of the tax revenue to social welfare programs.

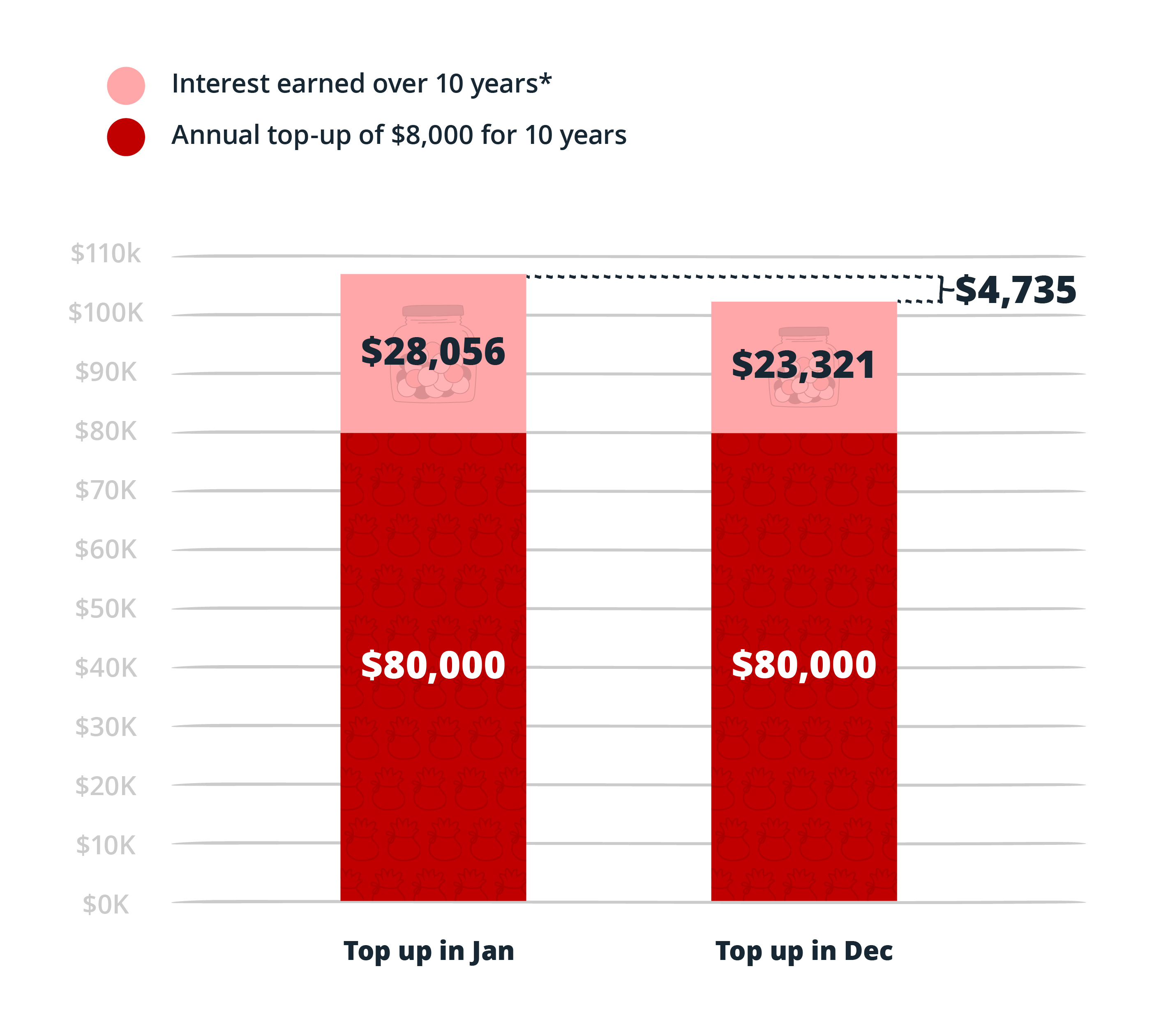

4 Ways to Maximise and Grow your CPF Savings for Retirement - Source www.dbs.com.sg

How to maximize your savings with CPF Na Nota:

- Make sure to provide your CPF number at every purchase.

- Shop at stores that offer discounts for CPF Na Nota participants.

- Use the CPF Na Nota app to track your savings and donations.

CPF Na Nota is a great way to save money and support Brazilian society. By participating in the program, you can help make a difference in the lives of those in need.

FAQ

Frequently Asked Questions about CPF Na Nota: Maximize Your Savings And Support Brazilian Society.

Por que colocar o CPF na nota? – ACONT Contábil – Compartilhe esta solução! - Source acontcontabil.com.br

Question 1: What is CPF Na Nota and how does it work?

CPF Na Nota is a Brazilian government program that allows individuals to earn cash rewards and contribute to social causes by providing their tax identification number (CPF) on retail receipts. When you make a purchase at a participating store, you can request to have your CPF included on the receipt. A portion of the taxes you pay on the purchase will then be credited to your CPF Na Nota account, which you can use to redeem for rewards or donate to eligible charities.

Question 2: Who is eligible to participate in CPF Na Nota?

Any individual with a valid CPF, including Brazilian citizens, residents, and foreign visitors, can participate in CPF Na Nota.

Question 3: How can I register for CPF Na Nota?

Registering for CPF Na Nota is quick and easy. You can visit the official website (www.notanfiscal.gov.br) and follow the registration instructions. You will need to provide your CPF number, name, email address, and other basic information.

Question 4: How can I earn rewards with CPF Na Nota?

You can earn rewards with CPF Na Nota by accumulating credits in your CPF Na Nota account. You earn credits every time you provide your CPF on a retail receipt. The amount of credits you earn depends on the total amount of the purchase and the participating store.

Question 5: How can I redeem my CPF Na Nota rewards?

You can redeem your CPF Na Nota rewards by logging into your account on the official website. You can choose to redeem your rewards for cash, gift cards, or donations to eligible charities.

Question 6: What are the benefits of participating in CPF Na Nota?

Participating in CPF Na Nota offers several benefits, including saving money on your purchases, supporting Brazilian society, and contributing to a more transparent tax system. By providing your CPF on retail receipts, you can earn rewards that can be used to reduce your expenses or donate to worthy causes. Additionally, CPF Na Nota helps to promote compliance with tax laws and ensures that the taxes you pay are used for the benefit of Brazilian citizens.

CPF Na Nota is a valuable program that offers a convenient and rewarding way to contribute to Brazilian society. By participating in the program, you can save money on your purchases, support important causes, and promote accountability in the tax system.

To learn more about CPF Na Nota, visit the official website (www.notanfiscal.gov.br) or contact the program administrator in your state.

Tips

Maximize savings and support Brazilian society through the CPF Na Nota: Maximize Your Savings And Support Brazilian Society program. Here are some effective tips to guide you.

Tip 1: Register for the Program

Registering for CPF Na Nota is crucial. Upon registration, you will receive a unique identifier that connects your purchases to your CPF (individual taxpayer identification number).

Tip 2: Provide Your CPF When Making Purchases

When making purchases at participating establishments, present your CPF or CPF Na Nota card. This ensures that a percentage of tax revenue from your purchases is credited to your CPF account.

Tip 3: Check Your Credit Balance Regularly

Monitor your CPF Na Nota account to track the balance of available credits. You can access your account online or through the mobile app to view current and past transactions.

Tip 4: Choose Partnered Establishments

Prioritize purchases from businesses that participate in CPF Na Nota. A list of participating establishments is available on the program's website, making it easy to identify and support partner businesses.

Tip 5: Redeem Credits Wisely

Redeem accumulated credits for discounts on future purchases or donate them to eligible social causes. Strategic use of credits maximizes savings and supports impactful initiatives.

Tip 6: Utilize CPF Na Nota App

Download the CPF Na Nota app for convenient access to account information, transaction history, and a list of participating establishments. The app enhances the overall user experience and simplifies participation.

Tip 7: Promote the Program

Spread awareness about CPF Na Nota among friends, family, and within your community. Encourage others to join the program, increasing the collective impact and strengthening social support.

Tip 8: Stay Informed

Stay updated with program updates, changes, and special promotions by regularly visiting the CPF Na Nota website or following the program on social media. Timely information ensures optimal participation and benefits.

CPF Na Nota: Maximize Your Savings And Support Brazilian Society

Maximize your savings and support Brazilian society with CPF Na Nota, a government initiative that offers tax benefits and rewards when consumers include their tax ID number (CPF) on receipts. This innovative program offers numerous advantages, from financial savings to social impact, making it an essential aspect of responsible citizenship.

- Financial Savings: Reduced taxes on purchases

- Social Impact: Funds public services and charities

- Accountability: Promotes transparency in tax collection

- Consumer Empowerment: Gives citizens a voice in resource allocation

- National Development: Contributes to social and economic progress

- Environmental Conservation: Supports sustainable initiatives

By participating in CPF Na Nota, consumers not only save money but also contribute to the well-being of their community. The funds raised through the program are allocated to essential public services, such as education, healthcare, and infrastructure. Additionally, CPF Na Nota promotes accountability and transparency in tax collection, empowering citizens to track the use of public resources. Its positive impact on society makes it an indispensable initiative for all Brazilians.

CPF na nota: será que vale a pena? - Source enotas.com.br

CPF Na Nota: Maximize Your Savings And Support Brazilian Society

CPF Na Nota is a Brazilian government program that allows consumers to request a tax invoice (Nota Fiscal) with their CPF (Cadastro de Pessoas Físicas) number. By doing so, consumers can accumulate points that can be redeemed for discounts on future purchases or donated to social causes. The program is a win-win for consumers, businesses, and the government.

Colocar o CPF na nota fiscal pode fazer você ganhar R$ 5 mil; saiba tudo! - Source pronatec.pro.br

Consumers can save money on their purchases by redeeming points for discounts. Businesses can increase sales by offering discounts to consumers who request Notas Fiscais. The government can increase tax revenue by ensuring that businesses are properly reporting their sales.

CPF Na Nota is an important component of the Brazilian tax system. It helps to ensure that businesses are paying their fair share of taxes and that consumers are getting the benefits they are entitled to. The program is also a valuable tool for social good. The points that consumers accumulate can be donated to social causes, such as education and healthcare. This helps to support important programs that benefit all Brazilians.

The practical significance of understanding the connection between CPF Na Nota and savings and social support is that it can help consumers make informed decisions about their purchases. By requesting a Nota Fiscal with their CPF number, consumers can save money and support Brazilian society at the same time.

| Benefit | Description |

|---|---|

| Consumer Savings | Consumers can save money on their purchases by redeeming points for discounts. |

| Business Sales | Businesses can increase sales by offering discounts to consumers who request Notas Fiscais. |

| Government Revenue | The government can increase tax revenue by ensuring that businesses are properly reporting their sales. |

| Social Support | The points that consumers accumulate can be donated to social causes, such as education and healthcare. |

Conclusion

CPF Na Nota is a valuable program that benefits consumers, businesses, and the government. By requesting a Nota Fiscal with their CPF number, consumers can save money, support Brazilian society, and help ensure that businesses are paying their fair share of taxes.

The program is a win-win for everyone involved. It is a simple and effective way to make a difference in the world.