Viral News | Explore around Viral and popular News this year

Cryptocurrency Market Today: Real-Time Prices, Trends, And News

Looking for "Cryptocurrency Market Today: Real-Time Prices, Trends, And News? Cryptocurrency Market Today: Real-Time Prices, Trends, And News keeps you up-to-date on current cryptocurrency trends, providing you with insightful analysis and research.

Editor's Notes: "Cryptocurrency Market Today: Real-Time Prices, Trends, And News" have published today date.

Recently, cryptocurrencies have attracted a lot of interest as a new asset class. Many people are interested in investing in cryptocurrencies, but they are unsure where to start. This guide will provide you with all the information you need to get started with cryptocurrency investing.

We've spent countless hours researching and analyzing the cryptocurrency market to assemble this guide. We've also included up-to-date information on the latest news, trends, and prices.

Key Differences or Key Takeaways:

| Cryptocurrency Market Today | Traditional Financial Market | |

|---|---|---|

| Volatility | Cryptocurrencies are more volatile than traditional financial assets. This means that their prices can fluctuate rapidly, and investors should be prepared for the possibility of losing money. | Traditional financial assets are less volatile than cryptocurrencies. This means that their prices tend to move more slowly, and investors are less likely to lose money. |

| Liquidity | Cryptocurrencies are less liquid than traditional financial assets. This means that it can be more difficult to buy or sell cryptocurrencies, and investors may have to pay higher fees. | Traditional financial assets are more liquid than cryptocurrencies. This means that it is easier to buy or sell traditional financial assets, and investors are less likely to have to pay higher fees. |

| Regulation | Cryptocurrencies are not regulated by the government. This means that there is no protection for investors if something goes wrong. | Traditional financial assets are regulated by the government. This means that there is some protection for investors if something goes wrong. |

Transition to main article topics:

This guide will cover the following topics:

FAQ

This comprehensive guide addresses frequently asked questions regarding the cryptocurrency market, offering authoritative answers based on up-to-date research and expert insights.

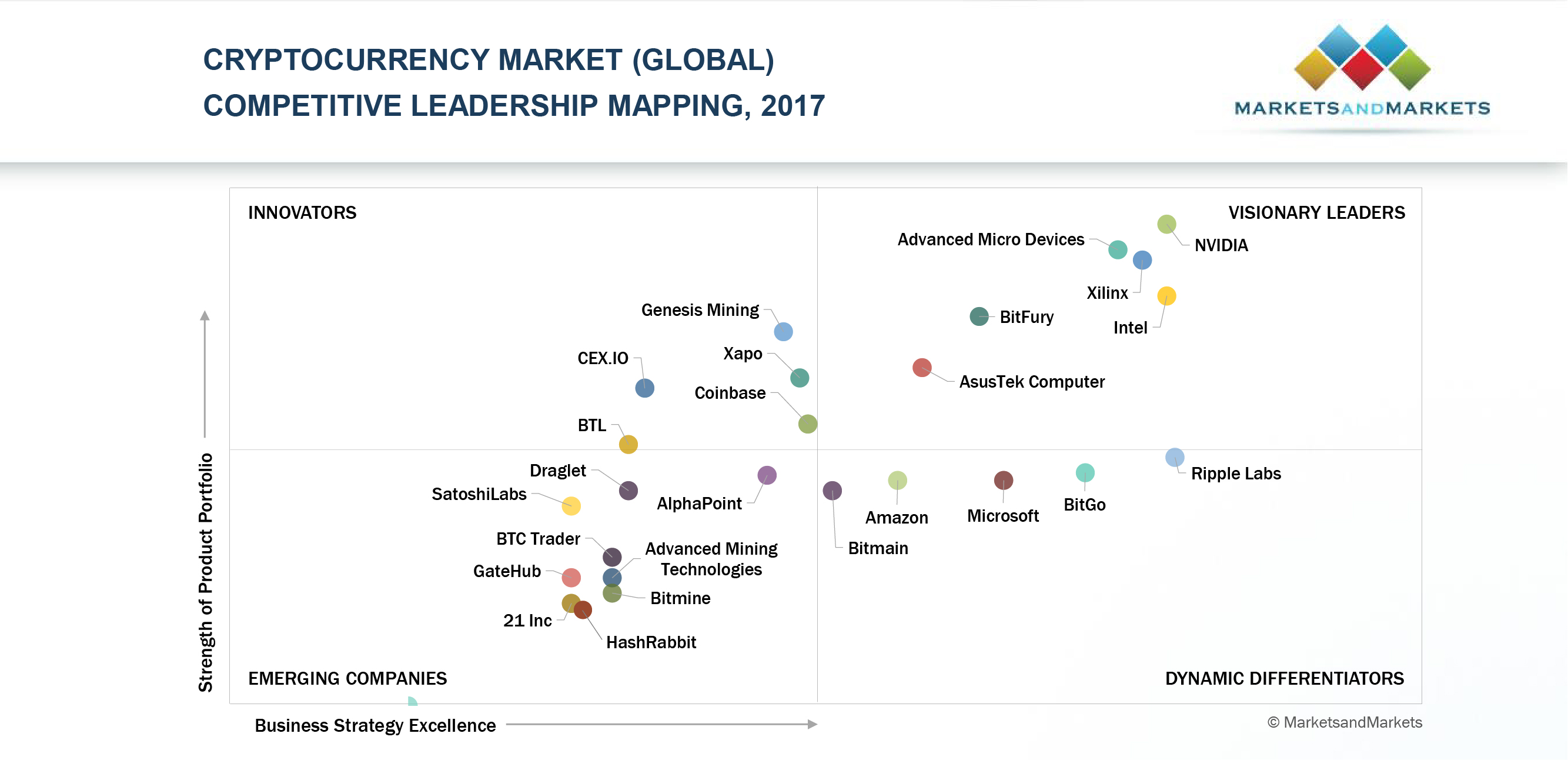

Cryptocurrency Market - Source www.marketsandmarkets.com

Question 1: What factors influence cryptocurrency prices?

Cryptocurrency prices are dictated by a complex interplay of factors such as supply and demand, market sentiment, regulatory updates, technological advancements, macroeconomic conditions, and geopolitical events.

Question 2: Is it risky to invest in cryptocurrencies?

Investing in cryptocurrencies entails a substantial degree of risk due to their inherent volatility and susceptibility to market fluctuations. However, it is crucial to note that different cryptocurrencies possess varying risk profiles, and investors should conduct thorough research before making any investment decisions.

Question 3: How can I stay informed about cryptocurrency news and trends?

Remaining updated on cryptocurrency news and trends requires diligent monitoring of reputable news sources, industry publications, and social media platforms dedicated to cryptocurrency discussions. Additionally, attending industry events, webinars, and conferences can provide valuable insights.

Question 4: What are the key differences between Bitcoin and Ethereum?

Bitcoin is primarily a store of value and a decentralized currency, while Ethereum serves as a platform for decentralized applications and smart contracts. Ethereum's blockchain technology enables the execution of complex transactions and the development of decentralized autonomous organizations (DAOs).

Question 5: How do I secure my cryptocurrency investments?

Securing cryptocurrency investments involves implementing robust cybersecurity measures such as using strong passwords, enabling two-factor authentication, storing assets in reputable hardware or software wallets, and being vigilant against phishing attempts.

Question 6: What are the potential long-term implications of cryptocurrency adoption?

The widespread adoption of cryptocurrencies has the potential to transform financial systems, facilitate cross-border transactions, and empower individuals by providing greater access to financial services. However, the full extent of these implications remains uncertain and subject to ongoing developments and regulatory frameworks.

These FAQs provide a solid foundation for understanding the intricacies of the cryptocurrency market. By staying informed and exercising due diligence, investors can navigate the complexities of this rapidly evolving landscape and make informed decisions.

Moving forward, the next article section will delve into the latest cryptocurrency market news and provide in-depth analyses of emerging trends and developments.

Tips

By monitoring real-time market data at Cryptocurrency Market Today: Real-Time Prices, Trends, And News, individuals can make informed decisions regarding their cryptocurrency investments.

Tip 1: Track Market Trends: Regularly check the live charts to identify price movements and emerging patterns. Understanding these trends can provide insights into potential market opportunities.

Tip 2: Monitor News and Announcements: Stay updated with the latest news and announcements related to specific cryptocurrencies, exchanges, and regulatory changes. Significant events can significantly impact market sentiment and token prices.

Tip 3: Analyze Trading Volume: The trading volume of a cryptocurrency indicates its liquidity and market demand. High volume suggests active trading, while low volume may indicate limited interest or potential volatility.

Tip 4: Diversify Portfolio: Consider investing in a mix of cryptocurrencies with varying risk profiles. Diversification can reduce overall portfolio risk and increase the likelihood of potential returns.

Tip 5: Use Technical Analysis Tools: Employ technical analysis tools such as moving averages, indicators, and chart patterns to identify potential entry and exit points.

By implementing these tips, investors can enhance their understanding of the cryptocurrency market, make strategic decisions, and mitigate potential risks.

Remember, the cryptocurrency market is highly volatile, and any investment decisions should be made after thorough research and risk assessment.

Cryptocurrency Market Today: Real-Time Prices, Trends, And News

The cryptocurrency market is a rapidly evolving landscape, characterized by constant fluctuation and the emergence of new trends. Understanding the key aspects of this dynamic market is crucial for investors and enthusiasts alike.

Cryptocurrency Market Cap Looks Set to Explode - Source fullycrypto.com

These key aspects provide a comprehensive view of the cryptocurrency market, helping investors make informed decisions. Real-time prices enable instant access to market movements, while market trends indicate potential investment opportunities. News and events can trigger significant price fluctuations, highlighting the need to stay updated. Technical and fundamental analysis provide deeper insights into market behavior and cryptocurrency value. Additionally, sentimental analysis can help investors gauge market sentiment and identify potential shifts in market sentiment. Understanding these aspects is essential for navigating the complexities of the cryptocurrency market effectively.

Cryptocurrency Market Today: Real-Time Prices, Trends, And News

The cryptocurrency market is a fast-paced and ever-changing landscape. With the advent of real-time price tracking, investors can now stay up-to-date on the latest market movements and make informed decisions about their investments. Real-time prices provide valuable insights into the supply and demand dynamics of cryptocurrencies, allowing traders to identify potential opportunities and risks.

Cryptocurrency stock market live | Aion - Source aion.pages.dev

Market trends are another crucial aspect of the cryptocurrency market. By analyzing historical price data and identifying patterns, investors can gain a better understanding of the overall market direction and potential future movements. Real-time trend analysis empowers traders to stay ahead of the curve and make strategic decisions based on market sentiment.

News and events have a significant impact on the cryptocurrency market. Positive news, such as the launch of a new product or service, can drive prices higher, while negative news, such as regulatory crackdowns or security breaches, can lead to sell-offs. Real-time access to news and updates keeps investors informed and allows them to respond quickly to changing market conditions.

Understanding the connection between real-time prices, trends, and news is essential for success in the cryptocurrency market. By leveraging these tools, investors can make informed decisions, identify opportunities, and mitigate risks in this dynamic and potentially lucrative market.

Conclusion

The combination of real-time prices, trends, and news provides invaluable insights into the cryptocurrency market. By staying informed about the latest market movements, identifying potential opportunities, and responding quickly to changing conditions, investors can navigate the complexities of the crypto market and maximize their returns. As the cryptocurrency market continues to evolve, the importance of real-time data and analysis will only grow, empowering investors to make informed decisions in this rapidly changing landscape.