Viral News | Explore around Viral and popular News this year

DIRF 2025: Comprehensive Guide For Timely And Accurate Filing

Our team has analyzed, dug information, and made a summary to put together this guide to help our target audience make the right decision.

This table summarizes the key differences between DIRF 2025 and previous years' DIRF filings:

| Feature | DIRF 2025 | Previous Years |

|---|---|---|

| Filing deadline | March 31, 2025 | February 28, 2023 |

| Penalties for late filing | Increased | Lower |

| New reporting requirements | Yes | No |

In addition to the changes outlined in the table, DIRF 2025 also includes a number of other new features and changes. These include:

- Electronic filing is required for all taxpayers (physical or non-residents)

- Digital signature is required for all e-filed returns

- New validation rules have been implemented to ensure accuracy of the filer's provided data

- Increased penalties for non-compliance

These changes are designed to improve the accuracy and completeness of DIRF filings. Taxpayers should carefully review the new requirements to ensure that they are in compliance.

FAQ

The following FAQs provide valuable insights and guidance on the DIRF 2025 filing requirements, ensuring timely and accurate submission.

Are you up to date on Timely-Filing requirements? – HBC - Source hbusinessllc.com

Question 1: What is the filing deadline for DIRF 2025?

The filing deadline for DIRF 2025 is May 31, 2025. Entities with over R$10,000,000.00 in gross revenue must submit the declaration electronically.

Question 2: Which entities are required to file DIRF 2025?

DIRF 2025 filing is mandatory for legal entities, including companies, non-profit organizations, government agencies, and individuals conducting business activities in Brazil.

Question 3: What information is required in the DIRF 2025 declaration?

The DIRF 2025 declaration requires detailed information on income, expenses, and withholding taxes related to various income sources, including salaries, dividends, and real estate rentals.

Question 4: Are there any penalties for late or inaccurate DIRF filing?

Yes, late or inaccurate DIRF filing may result in fines and interest charges imposed by the Brazilian tax authorities.

Question 5: How can entities ensure the accuracy of their DIRF 2025 filing?

To ensure accuracy, entities should carefully review and verify all data included in the DIRF declaration, utilizing supporting documentation and accounting records.

Question 6: Where can entities obtain assistance with DIRF 2025 filing?

Entities can seek guidance from qualified tax professionals, consult official documentation provided by the Brazilian tax authorities, or utilize online resources and forums.

By understanding and addressing these common questions, entities can ensure timely and accurate DIRF 2025 filing, fulfilling their tax obligations and avoiding potential penalties.

Visit our next article for a comprehensive guide on understanding the DIRF 2025 declaration.

Tips for Timely and Accurate DIRF 2025 Filing

DIRF (Declaração do Imposto sobre a Renda Retido na Fonte) is a mandatory annual tax return that provides information about income tax withheld at source on payments made to individuals and legal entities. The DIRF 2025 filing deadline is approaching, and it is essential to file accurately and on time to avoid penalties and ensure compliance.

Tip 1: Gather Necessary Documents Early

To prepare your DIRF return, you will need to gather all the necessary supporting documents such as income statements, payment details, and withholding tax certificates. Starting the collection process early will give you ample time to obtain any missing or incomplete documents.

Tip 2: Utilize the DIRF 2025 Software

The Brazilian tax authority provides free DIRF software that can significantly simplify the filing process. The software guides filers through each step of the declaration, performs automatic calculations, and checks for errors before submission. Using the official software ensures accuracy and reduces the risk of mistakes.

Tip 3: Verify Recipient Information

It is essential to ensure that the recipient information, such as name, address, and tax identification number (CPF or CNPJ), are accurate. Any discrepancies in recipient information can lead to processing delays or rejection of the return.

Tip 4: Double-Check Calculations

Pay particular attention to withholding tax calculations and ensure that they are correct. The DIRF 2025 software can help with automatic calculations, but it is still advisable to double-check the results manually or use a calculator to verify the accuracy.

Tip 5: File on Time

The DIRF 2025 filing deadline is strict. To avoid penalties, file your return on or before the due date. Late filings will incur fines and interest charges, so timely submission is crucial.

For more comprehensive guidance on DIRF 2025 filing, refer to the DIRF 2025: Comprehensive Guide For Timely And Accurate Filing.

Remember, accurate and timely DIRF filing is essential for tax compliance. By following these tips, you can ensure a smooth and efficient filing process, minimizing the risk of errors and penalties.

DIRF 2025: Comprehensive Guide For Timely And Accurate Filing

The Declaration of Information on Socioeconomic and Fiscal Data (DIRF) plays a significant role in the Brazilian tax system. By filing DIRF accurately and timely, companies can avoid penalties, maintain compliance, and assist the government in tax planning. To achieve this, it is important to understand the essential aspects of DIRF 2025 filing.

- Submission Deadline: Comply with the established deadline to prevent penalties.

- Data Accuracy: Ensure the accuracy of data to avoid disputes and additional scrutiny.

- Digital Signature: Secure and authenticate the submission using a digital signature.

- E-Filing: Use the electronic platform provided by the Brazilian Revenue Service.

- Supporting Documentation: Maintain necessary supporting documentation for audit purposes.

- Penalties: Adhere to regulations to avoid fines and legal consequences.

Timely Filing Appeal Letter Sample - SampleTemplatess - SampleTemplatess - Source www.sampletemplatess.com

These aspects are interconnected and contribute to the success of DIRF 2025 filing. Compliance with deadlines ensures timely submission. Data accuracy helps avoid discrepancies and penalties. Using a digital signature provides a secure and legally binding method. E-filing streamlines the process and eliminates manual errors. Maintaining supporting documentation protects against audits. Understanding penalties encourages timely and accurate filing. Together, these aspects ensure companies fulfill their tax obligations and maintain a positive relationship with the Brazilian Revenue Service.

DIRF 2025: Comprehensive Guide For Timely And Accurate Filing

DIRF 2025, the upcoming version of the Income Tax Return for Legal Entities (DIRF), is set to bring significant changes and enhancements to the filing process. This comprehensive guide has been compiled to assist taxpayers in understanding the new requirements, ensuring timely and accurate submissions, and leveraging the benefits offered by DIRF 2025.

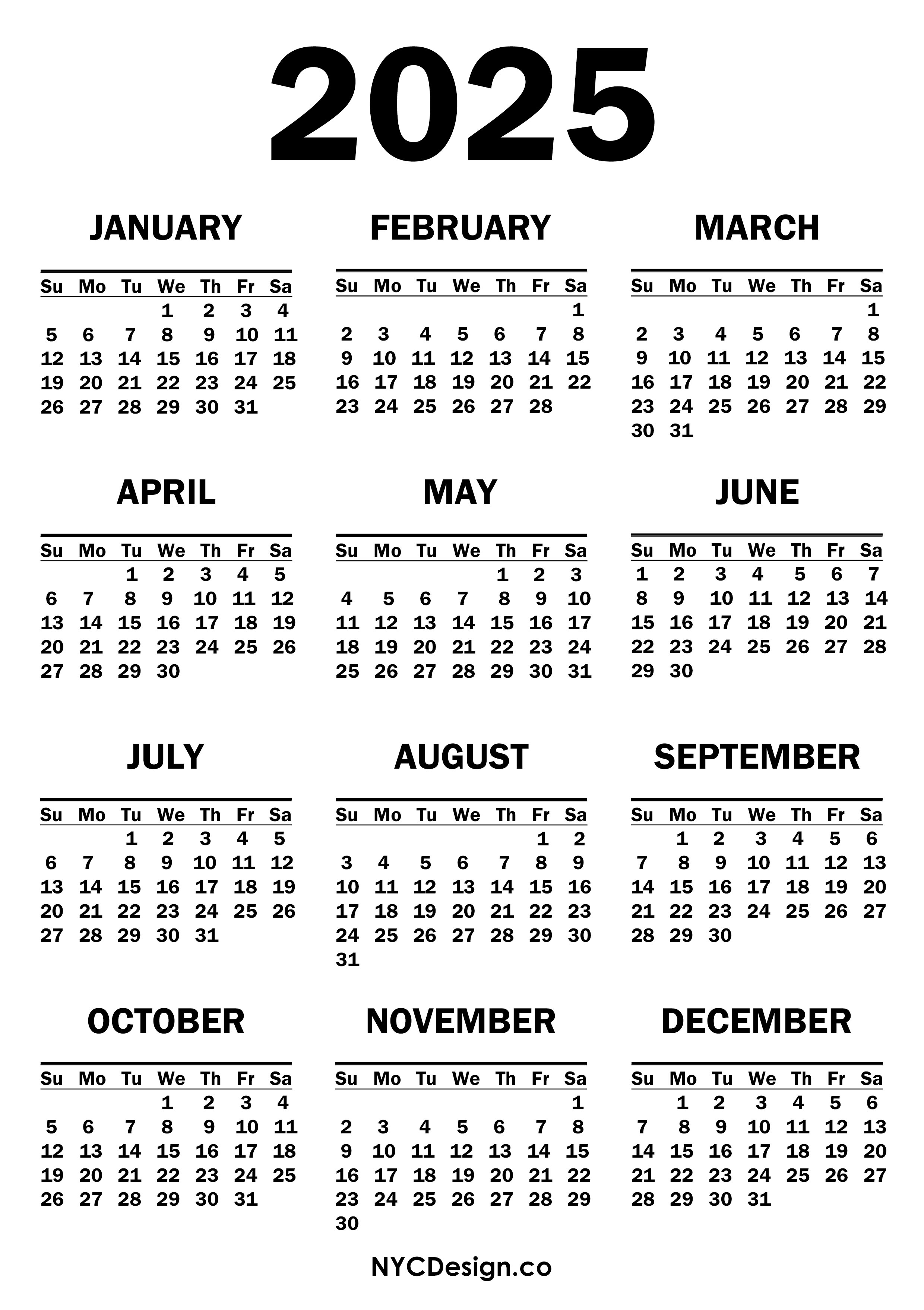

2025 Vertical Calendar: A Comprehensive Guide - List of Disney Project 2025 - Source 2025and2026schoolcalendar.pages.dev

The implementation of DIRF 2025 is driven by the need to streamline tax administration, enhance compliance, and facilitate data analysis for improved tax policy formulation. By providing a centralized platform for income and tax-related information, DIRF 2025 aims to reduce the burden on taxpayers and tax authorities alike.

The guide covers various aspects of DIRF 2025, including eligibility criteria, filing deadlines, supporting document requirements, and penalties for non-compliance. It also offers practical insights into the use of technology, such as e-filing and electronic signatures, to simplify the filing process.

Timely and accurate DIRF 2025 filing is essential for taxpayers to avoid penalties and potential legal complications. By understanding the requirements and utilizing the resources provided in this guide, taxpayers can ensure compliance, maintain good standing with tax authorities, and contribute to the efficiency of the tax administration system.

Conclusion

DIRF 2025 represents a significant step forward in the evolution of tax administration in the country. This comprehensive guide provides invaluable support to taxpayers, enabling them to navigate the new requirements and reap the benefits of the system. By embracing DIRF 2025, taxpayers can contribute to a more efficient and equitable tax system while ensuring compliance and avoiding potential penalties.

As the deadline for DIRF 2025 filing approaches, it is imperative for taxpayers to familiarize themselves with the guide and take proactive steps to ensure timely and accurate submissions. Proper planning and preparation will not only save time and effort but also avoid potential legal repercussions.