Viral News | Explore around Viral and popular News this year

MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook

MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook

MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook

[Provide in informative table format]

FAQ

This comprehensive FAQ section addresses common questions and misconceptions surrounding MicroStrategy's stock analysis, providing valuable insights into its growth prospects, key drivers, and future outlook.

Growth Prospects | MPY Technologies - Source mpytechnologies.com

Question 1: What are the key growth drivers for MicroStrategy?

MicroStrategy's growth is primarily driven by the increasing adoption of its business intelligence and data analytics software. The growing demand for data-driven decision-making and the need for organizations to extract insights from complex data sets are key factors fueling MicroStrategy's expansion.

Question 2: How has MicroStrategy's revenue performance been in recent quarters?

MicroStrategy's revenue performance has been mixed in recent quarters. While it has experienced periods of strong growth, there have also been quarters with revenue declines. This volatility is often attributed to the cyclical nature of the software industry and the timing of large contract signings.

Question 3: What is MicroStrategy's competitive landscape?

MicroStrategy faces competition from various players in the business intelligence and data analytics market. Key competitors include SAP, Oracle, IBM, Tableau, and Power BI. Each competitor offers unique strengths and weaknesses, and MicroStrategy must continue to differentiate its offerings to maintain its market share.

Question 4: What are the potential risks associated with investing in MicroStrategy?

Investing in MicroStrategy carries certain risks, including macroeconomic headwinds, intense competition, and the cyclical nature of the software industry. The success of MicroStrategy's business is also dependent on its ability to innovate and adapt to evolving customer needs.

Question 5: What is the company's long-term outlook?

MicroStrategy's long-term outlook remains positive. The growing demand for business intelligence and data analytics solutions suggests that the company is well-positioned for continued growth. However, it is essential to monitor the competitive landscape and the company's execution of its growth strategies.

By addressing these common questions and providing informed insights, this FAQ section offers a valuable resource for investors and analysts seeking a deeper understanding of MicroStrategy's stock analysis.

Next Section

Tips

To gain insights into MicroStrategy's growth prospects, key drivers, and future outlook, refer to MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook. This article provides a comprehensive analysis that can help investors make informed decisions.

Tip 1: Consider MicroStrategy's Business Model

MicroStrategy's core business is providing business intelligence (BI) and analytics software. Understanding its business model and its target market can help investors assess the company's growth potential.

Tip 2: Monitor Key Financial Metrics

Financial metrics such as revenue, earnings per share (EPS), and profit margins can indicate MicroStrategy's financial health and growth trajectory.

Tip 3: Track Industry Trends

The BI and analytics industry is constantly evolving. Staying updated on industry trends can provide insights into MicroStrategy's competitive landscape and potential opportunities.

Tip 4: Assess Management's Execution

The quality of MicroStrategy's management team and their ability to execute on strategic initiatives can impact the company's long-term success.

Tip 5: Monitor Regulatory Developments

Regulatory changes in the data privacy and cybersecurity space can affect MicroStrategy's operations. It is important to stay informed about potential regulatory impacts.

By following these tips, investors can enhance their understanding of MicroStrategy and make more informed investment decisions.

To learn more about MicroStrategy's growth prospects, key drivers, and future outlook, refer to the comprehensive article MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook.

MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook

MicroStrategy is a leading provider of business intelligence and analytics software. The company's stock has performed well in recent years, and analysts are bullish on its future prospects. Here are six key aspects to consider when analyzing MicroStrategy stock:

- Growth prospects: MicroStrategy is well-positioned to capitalize on the growing demand for business intelligence software. The company's software is used by businesses of all sizes to improve their decision-making and performance.

Prospects. New Opportunities and Future Achievements Stock Illustration - Source www.dreamstime.com - Key drivers: The key drivers of MicroStrategy's growth are its strong product portfolio, its large customer base, and its commitment to innovation.

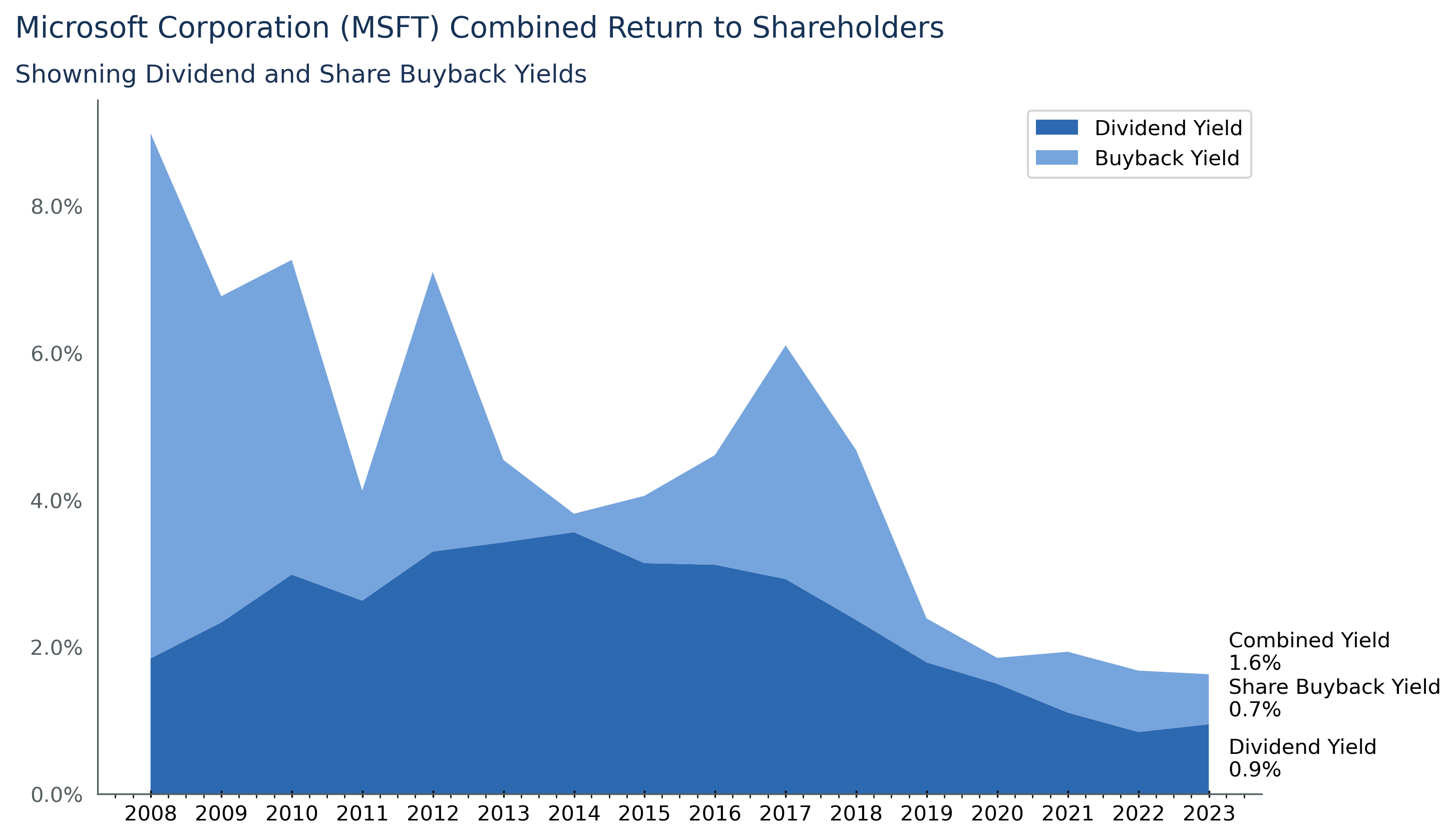

Microsoft's Future Growth Prospects (NASDAQ:MSFT) | Seeking Alpha - Source seekingalpha.com - Financial performance: MicroStrategy has a strong financial track record. The company has consistently reported healthy revenue and earnings growth.

Key drivers of economic growth | COMPLIANT PAPERS - Source compliantpapers.com - Valuation: MicroStrategy's stock is currently trading at a reasonable valuation. The company's price-to-earnings ratio is in line with its peers.

Analyzing a Company's Future Growth Investing Prospects - Source fxreviews.best - Risks: The key risks to MicroStrategy's business include competition from other software vendors and the potential for a slowdown in the economy.

Businessman Has Predicted the Future Prospects. Stock Illustration - Source www.dreamstime.com - Future outlook: Analysts are bullish on MicroStrategy's future prospects. The company is expected to continue to grow its revenue and earnings in the years to come.

Business People Instruction in Business Growth Chart Analysis , and - Source www.dreamstime.com

In summary, MicroStrategy is a well-positioned company with strong growth prospects. The company's key drivers, financial performance, valuation, and future outlook all point to continued success in the years to come.

MicroStrategy Stock Analysis: Growth Prospects, Key Drivers, And Future Outlook

MicroStrategy is a leading provider of business intelligence (BI) and mobile software. The company's stock has been on a tear in recent years, as investors have taken notice of its strong growth prospects. In this article, we will take a closer look at MicroStrategy's stock, examining its key drivers and future outlook.

Growth Prospects | MNJ Software - Source www.mnjsoftware.com

One of the key drivers of MicroStrategy's growth is the increasing demand for BI software. Businesses are increasingly turning to BI tools to help them make better decisions and improve their operations. MicroStrategy is a leader in the BI market, and its software is used by some of the world's largest companies.

Another key driver of MicroStrategy's growth is the company's focus on mobile software. Mobile devices are becoming increasingly important for business users, and MicroStrategy is well-positioned to meet this demand. The company's mobile software platform allows users to access their BI data and applications from anywhere.

MicroStrategy's future outlook is bright. The company is well-positioned to benefit from the growing demand for BI and mobile software. MicroStrategy's stock is a good investment for investors looking for growth potential.