Viral News | Explore around Viral and popular News this year

Pix Taxation: A Comprehensive Guide For Businesses And Individuals

Tired of sinking in endless research time to understand Pix Taxation? "Pix Taxation: A Comprehensive Guide For Businesses And Individuals" is the solution you've been waiting for!

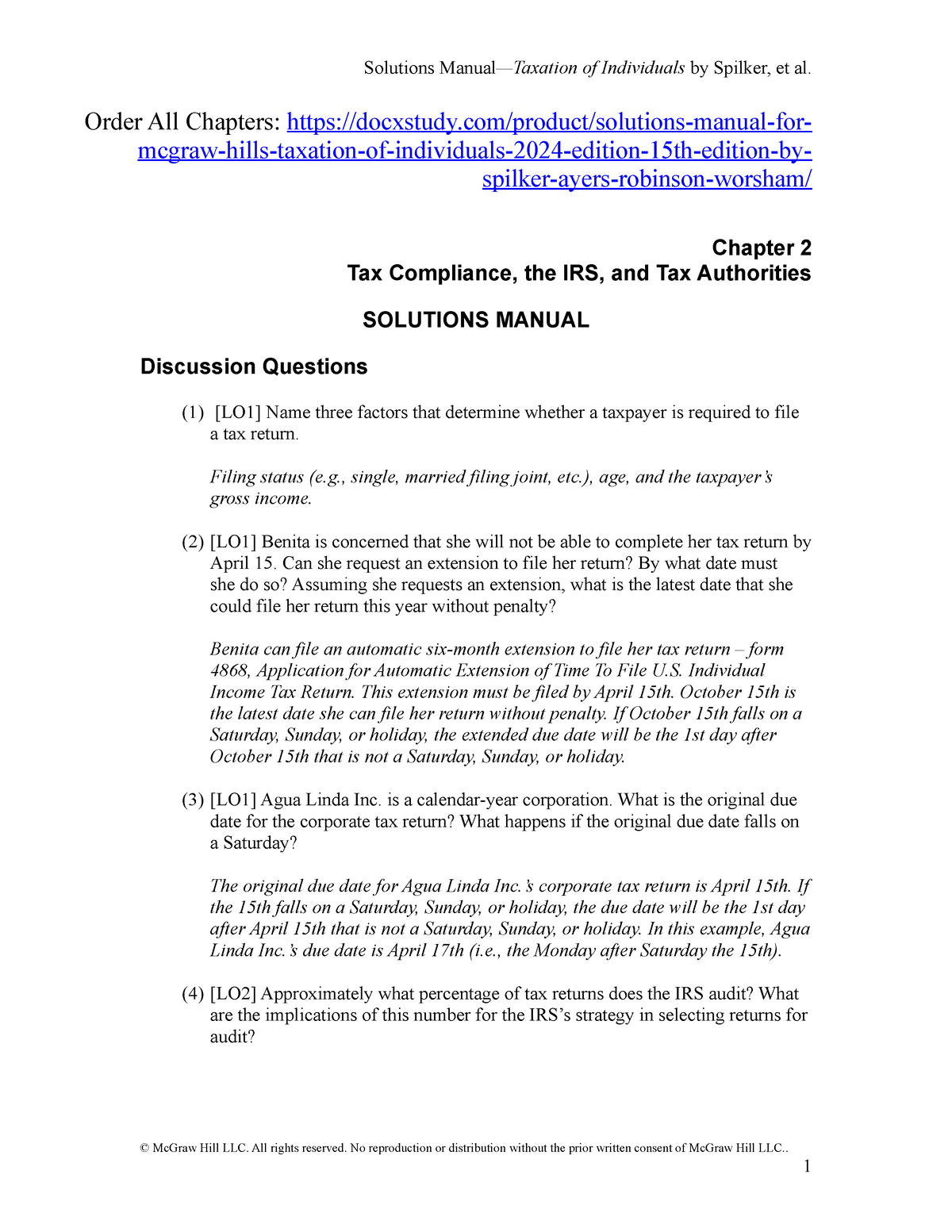

Taxation Of Individuals 2024 Pdf - Nelle Sophia - Source agatayrosaleen.pages.dev

Delve into "Pix Taxation: A Comprehensive Guide For Businesses And Individuals," a guide that clarifies all your perplexities, created after extensive analysis and thorough research. This guide ensures that individuals and businesses navigate the Pix taxation landscape seamlessly.

| Key Differences | Key Takeaways |

|---|---|

| - Straightforward syntax for easy comprehension | - Clarity on Pix taxation for efficient decision-making |

| - In-depth analysis for well-informed choices | - Practical guidance for navigating tax complexities |

Within this guide, you'll find:

FAQ

This comprehensive FAQ addresses commonly encountered queries related to Pix Taxation, aiming to provide clarity for businesses and individuals seeking guidance in this complex domain.

Mastering Taxation: A Comprehensive Guide to Tax Law and Practice by - Source www.goodreads.com

Question 1: What is the scope of Pix Taxation, and who does it apply to?

Pix Taxation encompasses a wide range of tax-related services designed to support businesses and individuals. Our expertise extends to tax planning, preparation, and advisory services, ensuring compliance with regulatory requirements and optimizing tax outcomes.

Question 2: How can Pix Taxation assist businesses with tax-related matters?

Businesses can leverage Pix Taxation's services to navigate the complexities of corporate taxation. We offer tailored solutions for tax planning, including entity selection, restructuring, and merger and acquisition strategies.

Question 3: What are the key benefits of working with Pix Taxation as an individual?

Individuals can entrust Pix Taxation with their personal tax needs, including income tax preparation, estate planning, and tax audits. Our team of experts works diligently to maximize deductions and minimize tax liabilities, ensuring financial well-being.

Question 4: How does Pix Taxation stay abreast of the constantly evolving tax landscape?

Pix Taxation recognizes the dynamic nature of tax regulations. Our team actively monitors legislative changes and industry best practices, ensuring that our clients receive up-to-date and informed advice.

Question 5: What sets Pix Taxation apart from other tax service providers?

Pix Taxation differentiates itself through its unwavering commitment to personalized service. We establish enduring relationships with our clients, tailoring our approach to their unique circumstances and long-term goals.

Question 6: How can businesses and individuals connect with Pix Taxation for consultation?

To initiate a consultation with Pix Taxation, prospective clients are encouraged to reach out via our website or designated contact channels. Our team will promptly respond to inquiries and schedule a convenient meeting.

Pix Taxation remains dedicated to empowering businesses and individuals navigate the intricacies of taxation, fostering financial stability, and ensuring regulatory compliance.

To delve deeper into the world of taxation and explore additional insights, continue to the next article section.

Tips for Businesses and Individuals

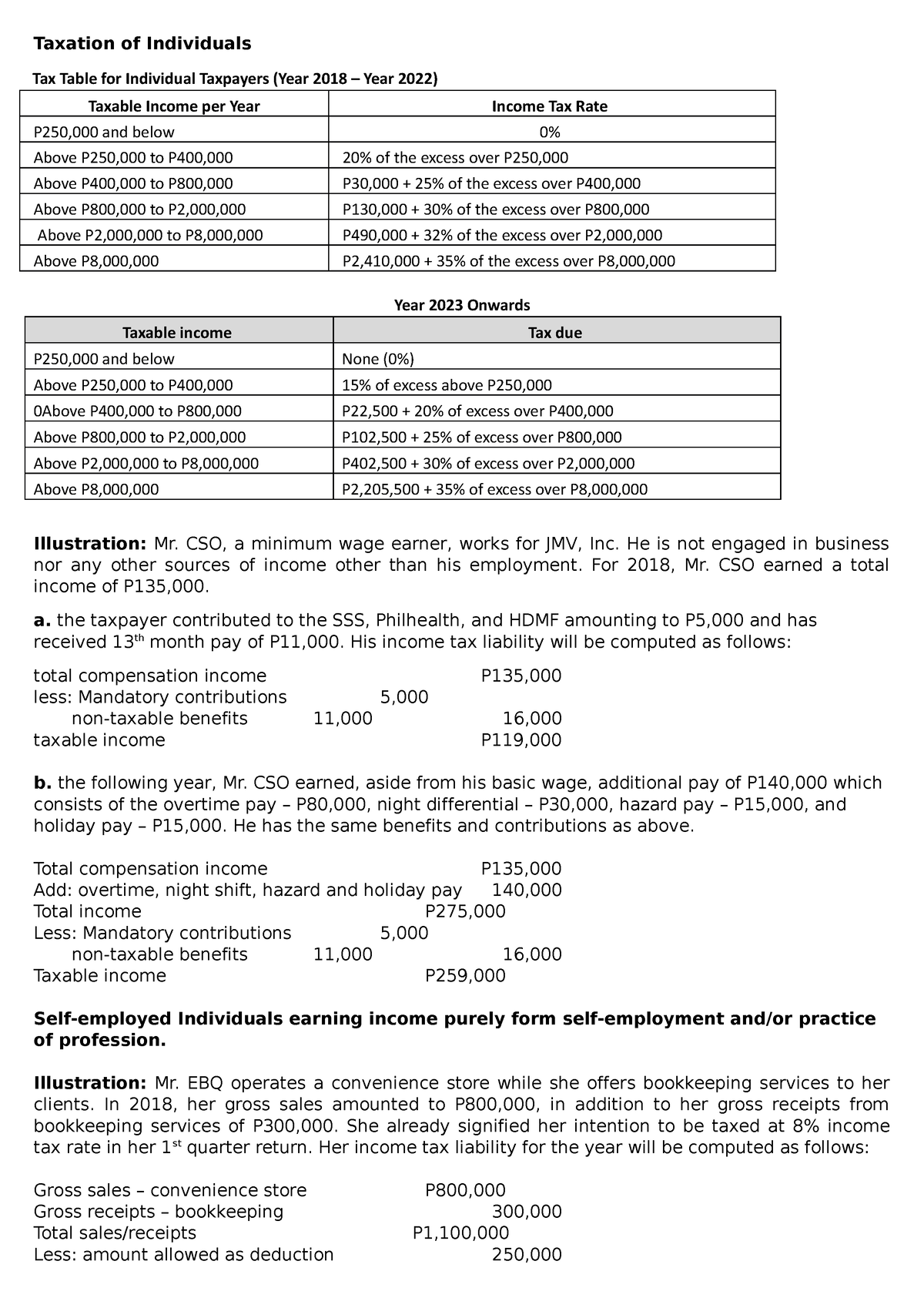

Taxation-of-Individuals - Taxation of Individuals Tax Table for - Source www.studocu.com

Pix Taxation: A Comprehensive Guide For Businesses And Individuals provides expert guidance on complying with tax regulations and maximizing savings. Here are some practical tips to simplify your tax management:

Tip 1: Keep accurate records. Organize all financial transactions, including receipts, invoices, and bank statements. This aids in accurate tax calculations and supports deductions and credits.

Tip 2: Maximize deductions. Identify eligible business expenses, such as office supplies, rent, and salaries, to reduce taxable income. Consider hiring a tax professional for expert advice.

Tip 3: Take advantage of tax credits. Research tax credits offered to businesses, such as the Research and Development Tax Credit, to offset tax liability.

Tip 4: Plan for estimated taxes. If self-employed or owning a business, estimate quarterly tax payments to avoid penalties. Consider using tax software or consulting a tax advisor for guidance.

Tip 5: File on time. Meet all tax filing deadlines to avoid penalties and interest charges. Utilize e-filing systems for convenience and accuracy.

By following these tips, businesses and individuals can navigate the complexities of taxation, ensure compliance, and optimize their financial position.

For more comprehensive tax management guidance, refer to Pix Taxation: A Comprehensive Guide For Businesses And Individuals.

Pix Taxation: A Comprehensive Guide For Businesses And Individuals

Pix taxation involves various aspects that businesses and individuals must comprehend to fulfill their tax obligations and optimize their financial positions. These key aspects provide a comprehensive overview of pix taxation, guiding businesses and individuals in navigating its complexities.

- Taxable Income: Determining the income subject to pix taxation.

- Tax Rates: Understanding the applicable tax rates for different types of income.

- Exemptions and Deductions: Identifying eligible deductions and exemptions that reduce taxable income.

- Filing Requirements: Complying with tax filing deadlines and submission procedures.

- Payment Options: Exploring various payment options available for pix taxes.

- Penalties and Interest: Avoiding potential penalties and interest charges by meeting tax obligations promptly.

Understanding these aspects empowers businesses and individuals to make informed decisions, minimize their tax liability, and maintain compliance with tax regulations. It enables them to optimize their cash flow, plan for tax payments, and avoid costly mistakes. By navigating the intricacies of pix taxation, businesses and individuals can ensure proper tax management and maximize their financial well-being.

/taxes-increase-636251470-5a7b1367a18d9e0036f31d2c.jpg)

When Are Income Taxes Due 2024 Canada - Kai Carolee - Source cathyleenwcory.pages.dev

Tax information. Vector illustration. Taxation - Royalty Free Stock - Source avopix.com

Pix Taxation: A Comprehensive Guide For Businesses And Individuals

Pix is a Brazilian digital payment system that has gained widespread popularity in recent years. It is a fast, convenient, and secure way to send and receive payments. However, businesses and individuals who use Pix need to be aware of the tax implications.

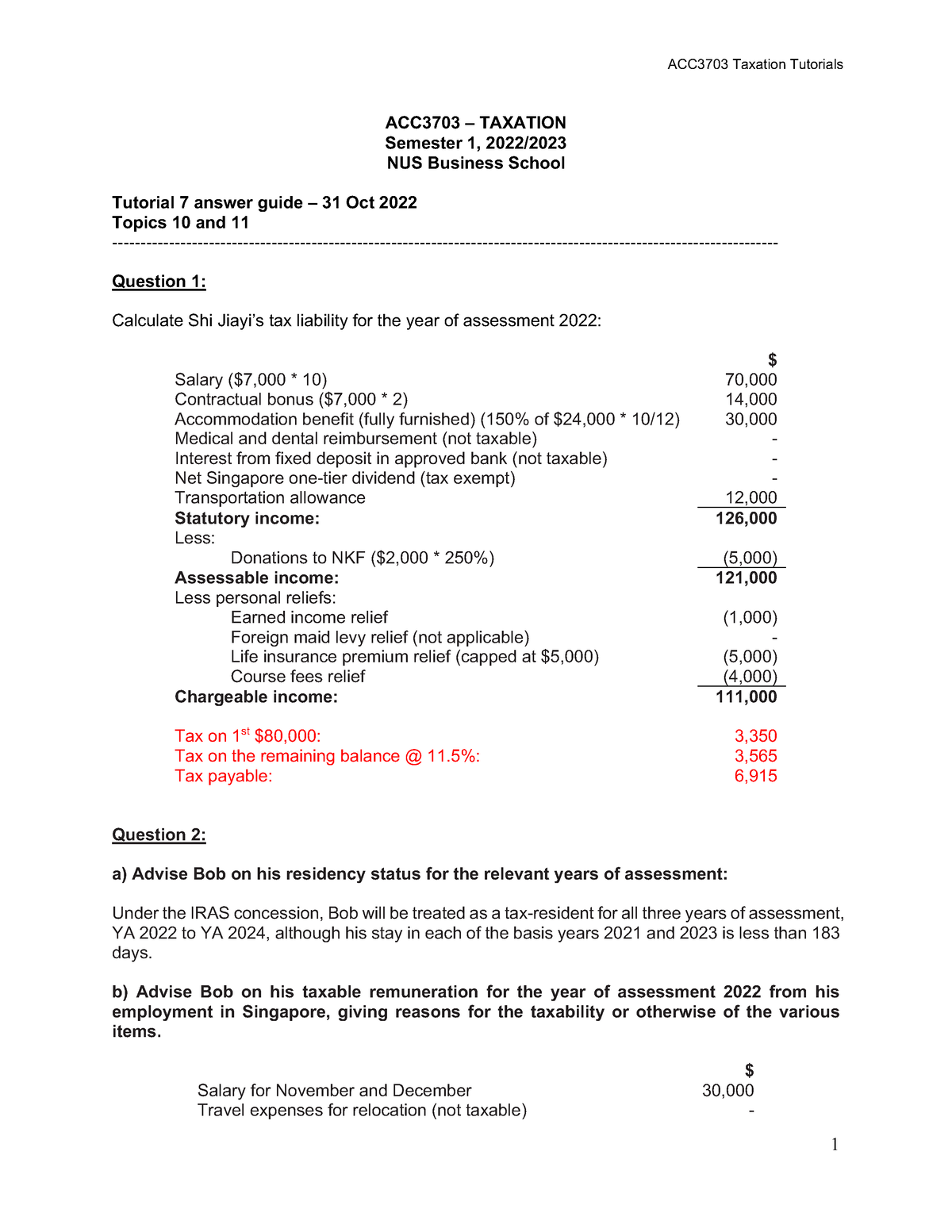

ACC 3703 Tut 7 - answer guide - ACC3703 Taxation Tutorials 1 ACC3703 - Source www.studocu.com

This guide provides a comprehensive overview of Pix taxation. It covers the following topics:

- What is Pix?

- How Pix transactions are taxed

- The tax implications of using Pix for businesses

- The tax implications of using Pix for individuals

- How to comply with Pix tax regulations

This guide is essential reading for any business or individual who uses Pix. It can help you to avoid costly tax mistakes and ensure that you are compliant with the law.

For businesses, Pix can be a valuable tool for streamlining payments and reducing costs. However, it is important to be aware of the tax implications before using Pix. Businesses that use Pix are required to charge value-added tax (VAT) on all taxable transactions. VAT is a consumption tax that is levied on the sale of goods and services. Businesses that fail to charge VAT on Pix transactions may be subject to penalties.

For individuals, Pix can be a convenient way to send and receive payments. However, individuals who use Pix may be subject to income tax on any income that they receive through Pix. Income that is received through Pix is considered to be taxable income. Individuals who fail to report income that they receive through Pix may be subject to penalties.

Complying with Pix tax regulations can be complex. However, there are a number of resources available to help businesses and individuals understand their tax obligations. The Brazilian Internal Revenue Service (IRS) provides a number of resources on its website, including a guide to Pix taxation. Businesses and individuals can also consult with a tax professional for help with understanding their tax obligations.

Conclusion

Pix is a valuable tool for businesses and individuals in Brazil. However, it is important to be aware of the tax implications before using Pix. Businesses and individuals who use Pix should consult with a tax professional to ensure that they are compliant with the law.

The use of Pix is expected to continue to grow in the coming years. As a result, it is important for businesses and individuals to be aware of the tax implications of using Pix. By understanding the tax laws and regulations, businesses and individuals can avoid costly tax mistakes and ensure that they are compliant with the law.