Viral News | Explore around Viral and popular News this year

Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari

Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari

Editor's Notes: "Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari" have published today date. This topic is important to read because it can provides information about staking and how taking part in staking can give you more income.

We did a lot of research, information gathering, and analysis. And then from that, we made Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari. Our Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari guideline assist you to make wise decision.

| Key Differences | Key Takeaways |

|---|---|

| Staking is a way to earn passive income from your cryptocurrency holdings. | Staking can be a good way to increase your crypto returns. |

| There are different types of staking, each with its own risks and rewards. | It is important to research the different types of staking before you get started. |

| Staking can be a complex process, but there are resources available to help you get started. | If you are new to staking, it is a good idea to start with a small amount of cryptocurrency. |

Transition to main article topics

FAQ

This section provides comprehensive answers to frequently asked questions regarding crypto staking, empowering you to make informed decisions.

Question 1: What is crypto staking?

Crypto staking is a process where individuals contribute their crypto assets to a blockchain network to validate transactions and earn rewards. By locking their assets, they contribute to the network's security and stability.

Crypto Staking – On Crypto, Bitcoin and DeFi - Source crypto.rahulgaitonde.org

Question 2: How do I choose coins for staking?

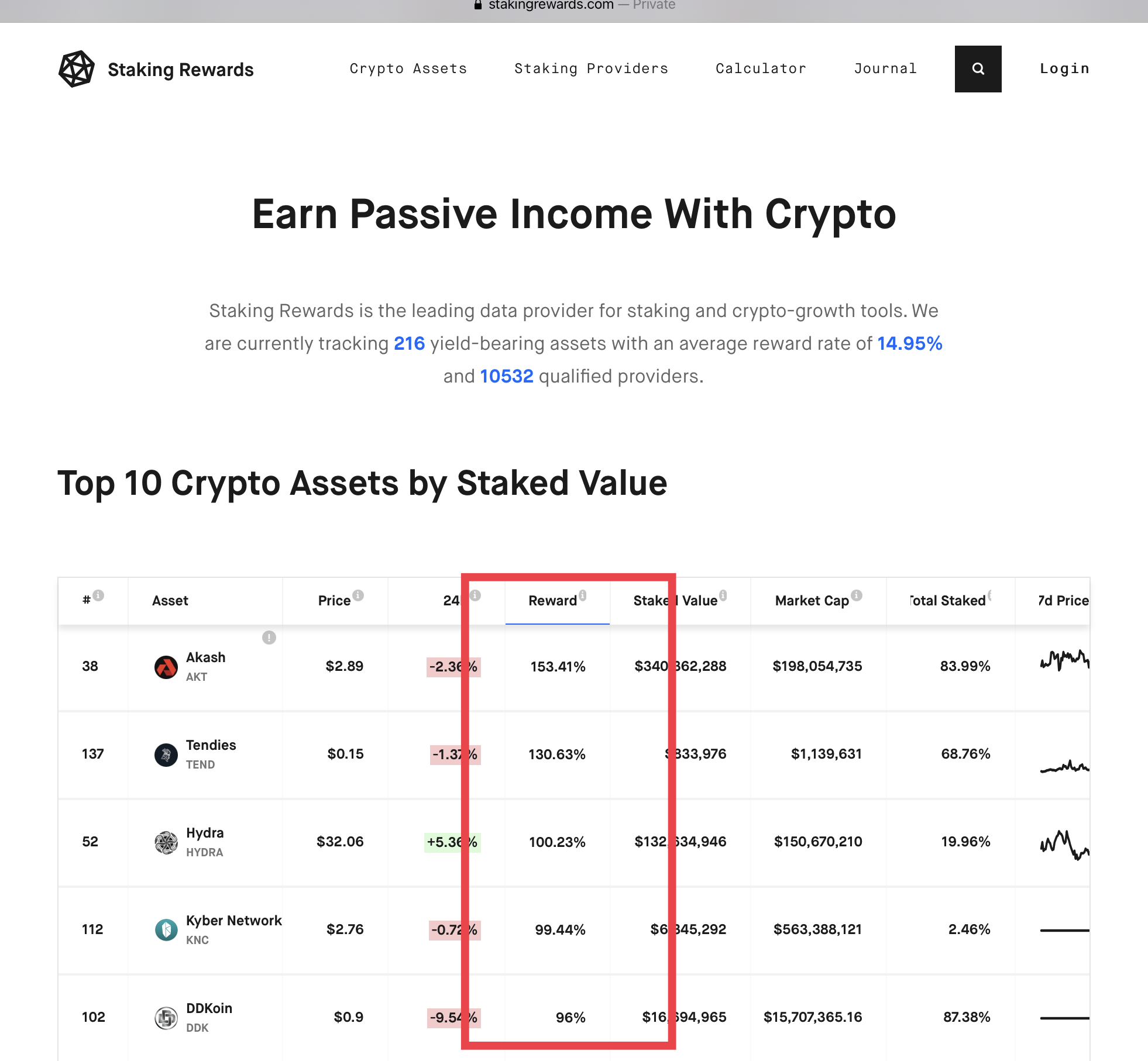

When selecting coins for staking, consider factors such as the coin's market capitalization, staking rewards, lock-up period, and the reputation of the network.

Question 3: What are the benefits of staking?

Staking offers several benefits, including passive income generation, support for the blockchain network, and potential for long-term appreciation of staked assets.

Question 4: What are the risks associated with staking?

Staking involves risks such as market volatility, smart contract vulnerabilities, and the potential for the staked assets to be lost or stolen.

Question 5: How do I start staking my crypto assets?

To start staking, choose a reputable staking provider, create an account, transfer your assets to the staking wallet, and select the desired staking period.

Question 6: What are the tax implications of staking?

The tax treatment of staking rewards varies depending on the jurisdiction. It is crucial to consult with a tax professional for specific guidance.

By understanding the intricacies of crypto staking, individuals can leverage this powerful tool to maximize their crypto returns while contributing to the growth and security of blockchain networks.

Transition to the next article section: Exploring the Future of Staking: Emerging Trends and Innovations

Tips

Staking is a crucial aspect of cryptocurrency investment that allows holders to earn passive income by actively participating in the network's consensus mechanism. By locking up or "staking" their coins, investors contribute to the security and stability of the blockchain while also reaping rewards for doing so. To maximize returns on crypto investments through staking, consider the following tips:

Tip 1: Research and Select Suitable Assets: Not all cryptocurrencies offer staking rewards, and those that do may have varying returns. Conduct thorough research to identify assets with a strong track record, active community involvement, and potential for growth.

Tip 2: Choose a Reliable Staking Platform: There are several platforms that offer staking services, each with its own features and fees. Evaluate options carefully, considering factors such as reputation, security measures, staking methods (e.g., cold or hot staking), and customer support.

Tip 3: Consider the Staking Duration and Rewards: Different assets have varying staking durations and reward structures. Some offer flexible staking with short lock-up periods, while others require longer commitments with potentially higher rewards. Assess the trade-offs and choose the approach that aligns with investment goals.

Tip 4: Minimize Risk by Diversifying: Avoid concentrating staking investments in a single asset. Spread participation across multiple assets or staking platforms to reduce risk and enhance yield potential.

Tip 5: Monitor Performance and Adjust Strategy: The cryptocurrency market is dynamic, and staking rewards can fluctuate. Regularly monitor the performance of staked assets and adjust the strategy as needed, such as by adding or removing coins from staking pools or exploring new opportunities.

Proven Crypto Staking Strategies: Maximize Your Rewards | Bitcompare - Source bitcompare.net

By following these tips, investors can Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari and maximize their passive income potential through this innovative crypto investment approach.

Staking offers a compelling way to earn rewards, support blockchain networks, and diversify investment portfolios. By implementing these strategies, investors can optimize their returns and reap the benefits of this powerful crypto investment tool.

Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari

Unlocking the full potential of staking requires a comprehensive understanding of its key aspects. These include Proof-of-Stake, Network Security, Passive Income, Coin Accumulation, Community Power, and Investment Strategy.

- Proof-of-Stake: Validating transactions based on staked coins.

- Network Security: Stakers ensure network stability and prevent malicious activity.

- Passive Income: Earning rewards for staking coins, regardless of market conditions.

- Coin Accumulation: Compounding rewards over time, increasing crypto holdings.

- Community Power: Participating in governance and shaping the future of the network.

- Investment Strategy: Integrating staking into a diversified investment portfolio.

These aspects work together to empower investors. Proof-of-Stake and Network Security contribute to trust and stability, enabling passive income generation and coin accumulation. Community Power gives stakers a voice, while Investment Strategy optimizes returns. Understanding these key aspects is essential for maximizing the benefits of staking and unlocking its full power.

![]()

Proof of Stake POS Icon. Crypto Staking Concept Stock Vector - Source www.dreamstime.com

Unlock The Power Of Staking: Maximize Your Crypto Returns With Staking 13 Januari

Unlocking the power of staking is a crucial aspect of maximizing crypto returns. Staking allows users to earn rewards by holding specific cryptocurrencies in their wallets and participating in the validation process of blockchain transactions.

What is crypto staking and how does it work? | Fidelity - Source www.fidelity.com

The connection between this topic and the overall theme of maximizing crypto returns is evident. Staking offers a passive income stream, enhancing the value of crypto holdings over time. Additionally, staking contributes to the security and stability of cryptocurrency networks, making it an essential component for long-term crypto investors.

Real-life examples abound, such as the Proof-of-Stake (PoS) consensus mechanism employed by Ethereum and Cardano. By staking their ETH or ADA tokens, users actively participate in transaction validation and earn rewards in the form of new tokens. This model aligns incentives and rewards individuals for their contributions to the network's security and performance.

Practically, understanding the connection between staking and crypto returns is essential for making informed investment decisions. Investors can select cryptocurrencies with favorable staking rewards and participation mechanisms to optimize their returns. Furthermore, staking provides an opportunity to generate passive income without the need for active trading or market timing.

Table: Key Insights on Staking

| Aspect | Insight |

|---|---|

| Concept | Staking is a consensus mechanism that allows users to earn rewards by holding and validating cryptocurrencies. |

| Benefits | Provides passive income, enhances crypto value, and contributes to network security. |

| Examples | Ethereum and Cardano are prominent cryptocurrencies that utilize staking. |

| Practicality | Investors can select cryptocurrencies with favorable staking mechanisms to maximize returns. |

Conclusion

In the ever-evolving world of cryptocurrency, staking has emerged as a powerful strategy for maximizing returns. It offers a passive income stream, enhances the value of crypto holdings over time, and contributes to the security and stability of crypto networks. Understanding this connection is essential for making informed investment decisions and unlocking the full potential of crypto returns.

As the cryptocurrency space continues to grow, staking is likely to become an increasingly important aspect for investors seeking alternative income streams and long-term value appreciation from their crypto holdings.