Viral News | Explore around Viral and popular News this year

IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil

Do you want to know about IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil? If you do, then you are in the right place!

Editor's Notes: "IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil" have published today date". This report is very important to read as it can help you understand the economic outlook for Brazil in 2024.

We have done some analysis, digging information, made IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil we put together this IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil guide to help target audience make the right decision.

![IPCA acumulado: o que é e qual a inflação hoje [2023] IPCA acumulado: o que é e qual a inflação hoje [2023]](https://investidorsardinha.r7.com/wp-content/uploads/2022/03/ipca-acumulado-o-que-e-e-qual-a-inflacao-hoje-2023.jpg)

IPCA acumulado: o que é e qual a inflação hoje [2023] - Source investidorsardinha.r7.com

FAQ

The following FAQs provide comprehensive answers to common questions and concerns regarding IPCA Acumulado 2024, offering valuable insights into inflation in Brazil.

Brazilian inflation accelerates to 0.23% in August - Pledge Times - Source pledgetimes.com

Question 1: What is IPCA Acumulado 2024?

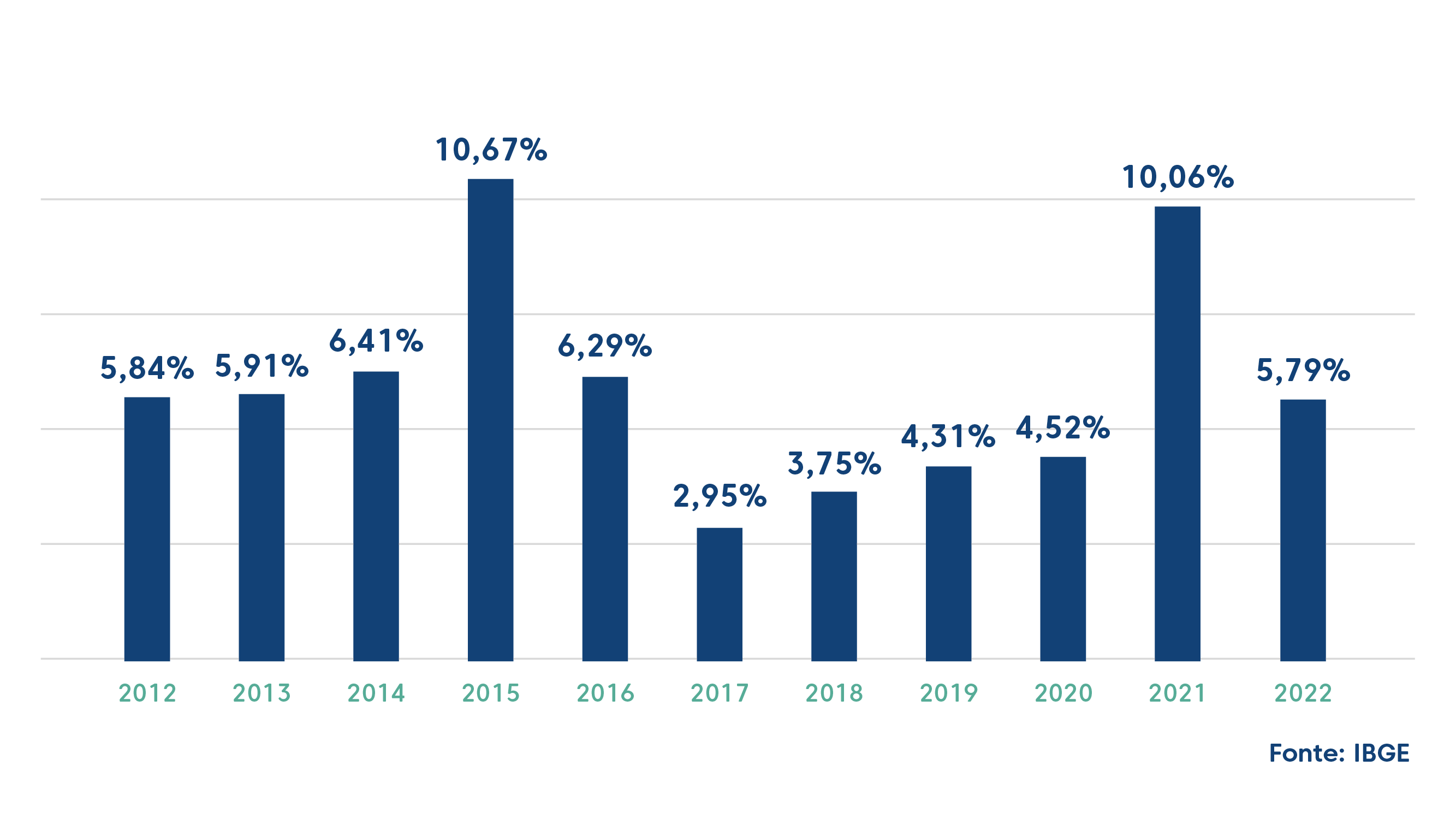

IPCA Acumulado 2024 refers to the accumulated Índice Nacional de Preços ao Consumidor Amplo (IPCA), the primary inflation index in Brazil, projected for the 12-month period ending in December 2024.

Question 2: How is IPCA calculated?

IPCA is calculated by measuring the monthly percentage change in a basket of goods and services purchased by households in Brazil's urban areas. This basket includes a wide range of items, from food and beverages to housing, transportation, and healthcare.

Question 3: What factors influence IPCA?

IPCA is influenced by various economic factors, including changes in supply and demand, exchange rate fluctuations, government policies, and international economic conditions.

Question 4: Why is IPCA important?

IPCA is a key indicator of inflation in Brazil. It is closely monitored by policymakers, businesses, and individuals as it affects economic growth, purchasing power, and investment decisions.

Question 5: What measures can be taken to control inflation?

Controlling inflation typically involves implementing monetary and fiscal policies aimed at managing money supply, interest rates, and government spending.

Question 6: What is the outlook for inflation in Brazil in 2024?

The outlook for inflation in Brazil in 2024 remains uncertain, influenced by global economic developments and domestic factors. However, policymakers are committed to maintaining price stability.

Overall, IPCA Acumulado 2024 is a crucial indicator that provides insights into inflation trends in Brazil. Understanding its calculation, influencing factors, and implications is essential for navigating economic conditions effectively.

Additional Resources:

Tips

This article, IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil, provides an overview of inflation in Brazil and offers strategies to mitigate its impact.

Tip 1: Track Inflation Regularly

Monitor inflation rates using official government statistics or economic news sources. This information will help you understand current trends and make informed financial decisions.

Tip 2: Diversify Investments

Spread your investments across different asset classes, such as stocks, bonds, and real estate. Diversification can reduce the risk of losses due to inflation eroding the value of a single asset type.

Tip 3: Consider Inflation-Linked Bonds

Invest in bonds that are indexed to inflation, such as Treasury Inflation-Protected Securities (TIPS). These bonds provide returns that adjust based on inflation levels.

Tip 4: Invest in Real Assets

Real assets, such as gold, real estate, and commodities, tend to retain their value during inflationary periods. Consider incorporating these assets into your investment portfolio.

Tip 5: Negotiate Inflation-Adjusted Contracts

When entering into contracts, such as loan agreements or employment contracts, consider including inflation-adjustment clauses. This will ensure that the value of the contract remains fair in the face of inflation.

Summary: By following these tips, you can mitigate the impact of inflation on your finances and make informed financial decisions in an inflationary environment.

Conclusion: Inflation is a complex issue with implications for both individuals and businesses. By understanding inflation and implementing the strategies outlined in this article, you can protect yourself from its negative effects and position yourself for financial success in the years to come.

IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil

Inflation in Brazil, as measured by the IPCA (Índice de Preços ao Consumidor Amplo), is a crucial economic indicator that influences various aspects of the country's financial landscape. Understanding the essential aspects of IPCA Acumulado 2024 is paramount for businesses, investors, and policymakers.

- Underlying Inflation

- Monetary Policy

- Economic Growth

- Household Spending

- Foreign Investment

- Exchange Rate

The IPCA Acumulado 2024 incorporates factors such as the expected trajectory of interest rates, supply chain disruptions, and global economic conditions. It also provides insights into the effectiveness of the central bank's monetary policy and its impact on economic growth and household spending. By analyzing these aspects, policymakers can make informed decisions to mitigate inflation and stabilize the economy.

IPCA | Carta de Conjuntura - Source www.ipea.gov.br

IPCA Acumulado 2024: A Comprehensive Guide To Inflation In Brazil

This guide presents an in-depth analysis of IPCA Acumulado 2024, an essential metric for understanding inflation in Brazil. IPCA, the Índice Nacional de Preços ao Consumidor Amplo, tracks the fluctuation of consumer prices and provides valuable insights into the purchasing power of Brazilians.

Ipca 2024 - Anny Malina - Source lillaqnicole.pages.dev

By examining the 2024 projections, this guide offers a comprehensive roadmap for businesses, investors, and policymakers seeking to navigate the economic landscape in Brazil. IPCA Acumulado 2024 serves as a pivotal component, providing a benchmark against which inflation trends can be monitored and understood.

The practical significance of this understanding lies in its ability to inform decision-making and strategic planning. Businesses can adjust their pricing strategies, while investors can assess the impact of inflation on their portfolios. policymakers can implement measures to mitigate the effects of inflation and support economic stability.

Table: Key Insights

| Attribute | Key Points |

|---|---|

| Inflation Rate | IPCA Acumulado 2024 projections provide a comprehensive overview of expected inflation rates throughout the year. |

| Economic Stability | understanding of inflation helps businesses and policymakers in decision-making to maintain economic stability. |

| Investment Planning | IPCA Acumulado 2024 is crucial for investors in assessing the impact of inflation on their portfolios and making informed investment decisions. |

Conclusion

The exploration of IPCA Acumulado 2024 in this guide emphasizes the critical role it plays in understanding inflation in Brazil. Its significance lies in providing a benchmark and enabling informed decision-making for various stakeholders.

As Brazil navigates its economic landscape, IPCA Acumulado 2024 will continue to be an indispensable tool for assessing inflation trends, enabling businesses, investors, and policymakers to adapt effectively and maintain economic stability.